A few days ago, I went to the Post Office inside my local Pharmaprix (which is what Shoppers is called in Quebec) and saw 6 bags of organic tortilla chips discounted at $1 each!!!!

I had to buy all of them, since I enjoy making nachos on Friday night. And given their regular price was $5.79 per bag, I saved more than 28$!

They were discounted because they were past the expiration date, but we are talking about salt and corn flour; I would eat them with confidence even if they were 5 years past their expiration date!

The moral of the story?

Keep an eye out for deals on expired food. And if you don’t find it at your local Shoppers or grocery store, you should know there are apps entirely dedicated to selling expired food items. As a matter of fact, one of our writers spent an entire week only eating expired food from those apps and she is still alive and well today!

Speaking of groceries, we just published a piece on MooseMoney.com about how easy it is to save money by requesting price matches at your local grocery store.

Before I let you read the newsletter, I also wanted to let you know that, starting this week, we will feature a side hustle of the week that is easy enough that anyone reading this newsletter could give it a go and start making more money!

PS: Don’t be surprised if this newsletter keeps evolving. My goal is to make each issue better than the previous one and to do that, I need your feedback! So if you feel something is missing, or if you have questions you would like me to answer in the next issue, feel free to reply to this email. I read and respond to every message, so you can count on getting an answer!

Julien Brault, aka JB, Co-Founder of MooseMoney.com

Recently published on MooseMoney.com

I Tested the Top 5 High-Interest Savings Accounts in Canada So You Don't Have To

I Requested A Price Match At Four Ontario Grocery Stores And Here’s How It Went

I Figured Out The Best Way To Pay Off Debt Collectors To Rebuild Your Credit Score

Side Hustle Of The Week: Gift Wrapping!

During last year’s holiday season, CNBC Make It featured Michelle Hensley, founder of Nifty Package Co., who turned a creative gift-wrapping side gig into a full-blown business. Within four days of posting her offer, she landed her first job and soon attracted corporate and celebrity clients, including Kim Kardashian, who loved her unique gift-wrapping style. Today, she charges over $180 per hour for gift wrapping, bringing in hundreds of thousands of dollars in revenue annually.

While it’s become a full-time business for Hensley, she believes gift-wrapping is still a fantastic side hustle for anyone to start, because you don’t need a massive startup budget and there’s real cash-flow potential if you build a recognised style and reach the right clients. In the article, she does point out that you “need to have a sought-after style and know how to reach clients.”

How to get started?

- Approach the concierge service at an office tower about leasing a small corner space.

- Create a portfolio of wrapped gifts, set up Instagram/Pinterest to showcase your “signature wrap,” and network with local retailers or corporate gift-buyers.

- Many neighbourhood Facebook groups allow service posts, especially seasonal ones. Offering weekend gift-wrapping pop-ups, at-home wrapping, or “drop-off-pick-up” packages can get quick traction.

- Florists, boutique gift shops, chocolate stores, and holiday pop-up markets LOVE add-on services. Ask if you can set up a small table in their store during December. Offer them 10–20% of sales or a flat rent of $50–$150/day, depending on foot traffic. It gives their customers a premium add-on and makes you look more “official.”

- Contact realtors, mortgage brokers, and financial advisors. These professionals are always giving clients gifts, especially at year-end. Offer a volume discount (e.g., $15–$30 per wrap for 20+ gifts).

What about pricing? According to Hensley’s pricing, you could charge $20- $50 per package for à la carte items, plus add-ons (ribbon upgrades, next-day service). Remember, people who hire out gift-wrapping typically have money to spend.

With the right style and marketing, you could transform a weekend gig into a full-time income stream.

If you need a little more inspiration, this article offers practical tips on converting your gift-wrapping skills into a side hustle!

Source: CNBC Make-It

PayPal launches interest-free “Pay in 4” BNPL option in Canada

In a recent press release, PayPal announced it's expanding its “Pay in 4” buy now, pay later (BNPL) service to Canada, offering customers a no-interest, no-fee option for purchases from top brands such as Home Depot, Ticketmaster, and Samsonite.

If you’re approved for the program, you can split purchases from $30 to $1,500 CAD into four equal payments over six weeks, with no late fees or sign-up costs. Your payments are automatically scheduled, and you can fund the instalments via debit, credit, or your bank account.

BARRY CHOI: How I used Marriott points to book a five-night hotel stay in Hong Kong

It’s always special to return to the city where my parents are from. My flight was covered, but I paid for the hotel myself. Usually, I offset those costs with points, but Hong Kong threw me a few curveballs.

I’m loyal to Marriott, thanks to my Marriott Bonvoy American Express Card. It offers an annual free night certificate and lets me transfer Amex Membership Rewards points to Marriott Bonvoy at a 1:1.2 ratio.

For this five-night stay, I booked the Sheraton, priced at $449 or 60,000–65,000 points per night. That gives a cost per point (CPP) of roughly 0.69–0.74 cents. Not ideal, considering I value Bonvoy points at 0.8 cents each.

But here’s the twist: Marriott’s fifth-night-free perk means I only needed 252,000 points to cover the whole stay, saving $2,245. That bumps the CPP to 0.89.

While the math favoured me, I still questioned the value. Another Marriott property, just a 10-minute walk away, had the same cash rate but required only 200,000 points. That’s a killer CPP of 1.12. I passed because it lacked a lounge and free breakfast for status members. Spending an extra 52,000 points for those perks felt worth it, only because I’m points-rich.

Zoom out a bit, and you’ll find hotels in Mong Kok (just 12 minutes by subway) for around $200 a night. Not Marriott, but half the price. In a city like Hong Kong, the extra transit time is negligible. From a pure cost perspective, staying further out would’ve made more sense.

Points enthusiasts often chase value obsessively. However, sometimes paying cash, especially when cheaper options are available, is the smarter move. Considering points can be devalued at any time, hoarding them isn’t in your best interest.

Loyalty programs aren’t for everyone. But if you learn the rules of the game, you can play it well and win. If you don’t want to bother, think about a cash-back card. You may not have access to premium hotels or fancy flights, but saving your cash back earned for travel can help you save money.

This guest post was authored by Barry Choi, an award-winning personal finance expert who specializes in credit cards and loyalty points.

Make Your Money Work For You With Neo!

With the Neo Savings account, you earn between 2.25% and 2.9% interest depending on how much you keep in the account. Balances under about $5,000 earn 2.25%, those around $5,000 to $20,000 earn 2.5%, and anything over $20,000 earns 2.9%. There are no fees and the rate isn’t a short-term promo. It’s what you earn every day your money stays in the account.

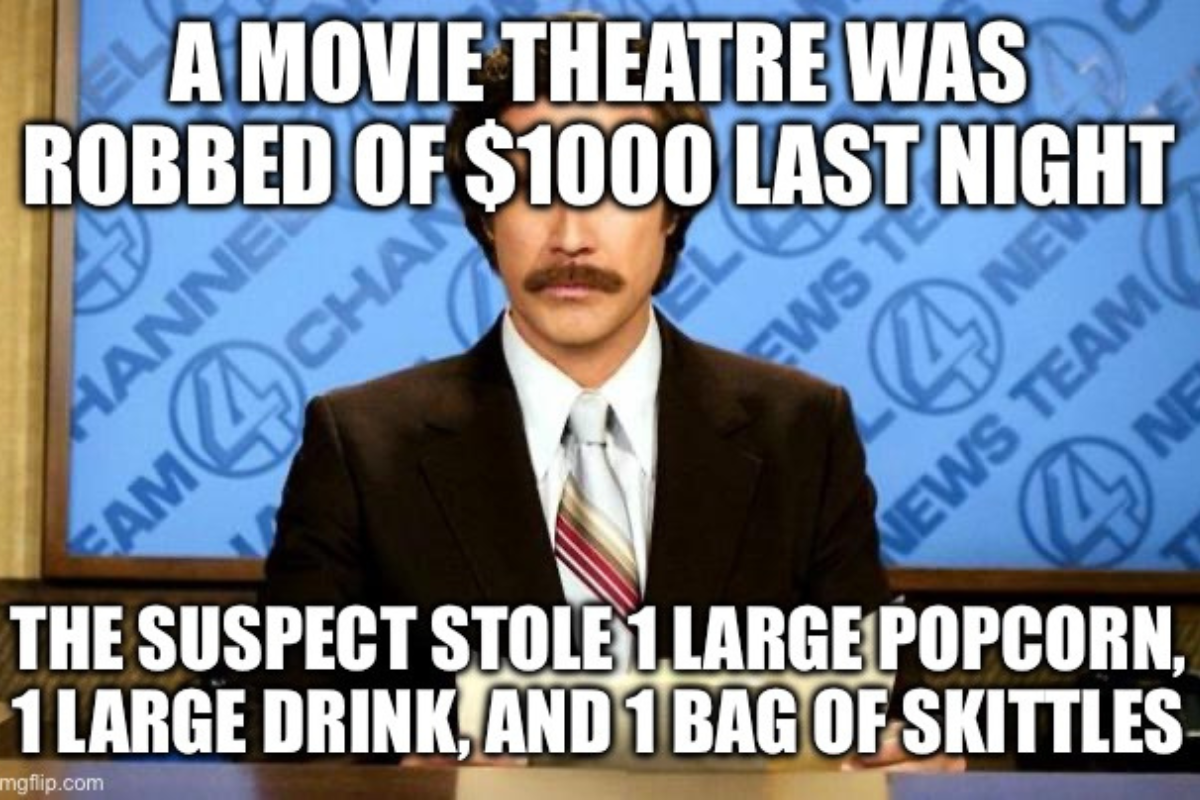

Cineplex launches “Monday Surprise Premieres” at discounted prices to boost weekday attendance

Cineplex is introducing a fresh movie-night offering called “Monday Surprise Premieres.” It kicked off on Monday, November 10, 2025, and features a brand-new (unreleased) film shown at select Canadian venues, but here’s the catch: you won’t know the title until the movie starts! The in-theatre ticket price is $8.99 (there’s an extra fee of up to $1.50 if you book online). It’s a great deal, considering new-release adult tickets at Cineplex are usually around $16, so you’re saving roughly 50% off standard pricing. If you’re curious and flexible about what movie you will see, it makes for a great, budget-friendly outing! Just make sure your local theatre is participating and book early because it’s already drawing interest.

Source: CTV News

Financial Calculator of the Week

Find out exactly how long it will take to pay off your credit card by paying only the minimum versus paying a higher amount each month, and see how much interest you'll save.

Toronto plasma donor shares what it’s really like earning $70-$100 per visit

A Toronto Redditor recently shared their experience donating plasma for cash at a Grifols Plasma Centre in North York. They explain that Plasma donation is different than giving blood. You sit in a recliner while blood is drawn, plasma is separated by centrifuge, and your blood plus saline is returned to your body. They can collect almost a litre of plasma, and because it regenerates within 24 to 48 hours, you can donate twice a week.

According to the Redditor, they pay $100 for your first three donations, then $70 or $60 per visit, depending on your volume.

Pros include a solid payout, helping others, friendly staff, and a complete medical screening (including STDs, HIV, and Hepatitis).

Potential cons are that it’s time-consuming (3 hours for the first visit, around 2 hours afterward), involves long medical questionnaires, and leaves you feeling wiped out for the rest of the day. There are also many medical/drug restrictions, though cannabis is fine if you haven’t used it in 12 hours.

If you’re interested in donating plasma, Grifols has several locations across Canada, including major centres like Calgary, Edmonton, Winnipeg, and Halifax.

Source: Reddit

Bountii Canada launches a coupon platform promising trust and transparency for Canadian shoppers

If you’ve ever tried to save money with online coupon sites, you know that they’re full of expired codes, sketchy links, and “deals” that don’t apply at checkout. Bountii Canada has officially launched its platform, designed to turn couponing into a more positive experience for Canadian shoppers. The site features live discount codes from verified retailers, keeps expired codes visible (so you can see what has worked before), and removes or flags codes that fail, cutting down on wasted clicks. Every store listed has its own dedicated “listing page” showing active and past codes, and all links take users directly to the retailer’s official website. We tested several discount codes from stores like Amazon, Best Buy, Old Navy, and Ikea, and found some great deals. It’s definitely a tool that can help you avoid dead ends and find real savings faster.

Source: NewsFileCorp

🚨🏷️ Moose on the Loose in Dealville

LEGO Classic Creative Build-and-Play Box

$29.86

The LEGO Classic Creative Build‑and‑Play Box is your imagination’s new best friend! Inside this colourful treasure chest are 750 vibrant bricks, three large “16 × 16” baseplates, and fun extras like eyes, wheels, and windows so you or a kiddo can build pretty much anything: a fire truck with a ladder, a rainbow cloud, a typewriter, a house… you get the idea. It’s designed for ages 5 +, so even the little moose-in-training can dive in. And the real treat? When it’s on sale, it's an easy “yes” from Money Moose —lots of build-fun for your buck. If you’ve been waiting for a creative gift or just a reason to play with bricks again, this is it.

Blink Video Doorbell + Outdoor 4

$54.99

Meet the Blink Video Doorbell + Outdoor 4 Bundle, and give your house a serious security upgrade. This clever set includes a head-to-toe HD video doorbell and an Outdoor 4 wireless security camera, both boasting up to 2 years of battery life. That’s right, two whole winters without scrambling for a new battery! You’ll get crisp 1440p video on the doorbell, 1080p on the camera, infrared night vision, motion alerts, and two-way audio. The setup is pretty simple. Batteries, sync module, and app are included. If you’ve been thinking about leveling up your home security without turning into a tech hermit, now’s the time. Money Moose approves.

No Name Windshield Washer Fluid

$3.00

I’ve found a slick little deal sliding down the windshield like a snowflake in November: the windshield washer fluid at No Frills. It might not sound glamorous, but this clear-liquid troop does one heck of a job when your windshield starts looking like a moose’s breath after a winter sprint. Just pour it in, and suddenly your wipers stop smearing, the road ahead becomes crystal, and you save cash you can spend on something cooler, like actual snowshoes (just kidding, but maybe). If you’ve got a car, this is one of those little victories where responsible meets “hey, that was easy.” Grab it, top up the reservoir, and give your ride a fresh start.