Last week, my train from Toronto to Montreal was delayed 15 minutes, and then another 30 minutes…

Passengers got angry and someone from VIA Rail tried to calm us down with free mini bags of pretzels, granola bars and water bottles. I took three instead of one, as help yourself does not mean 1 per person, right?

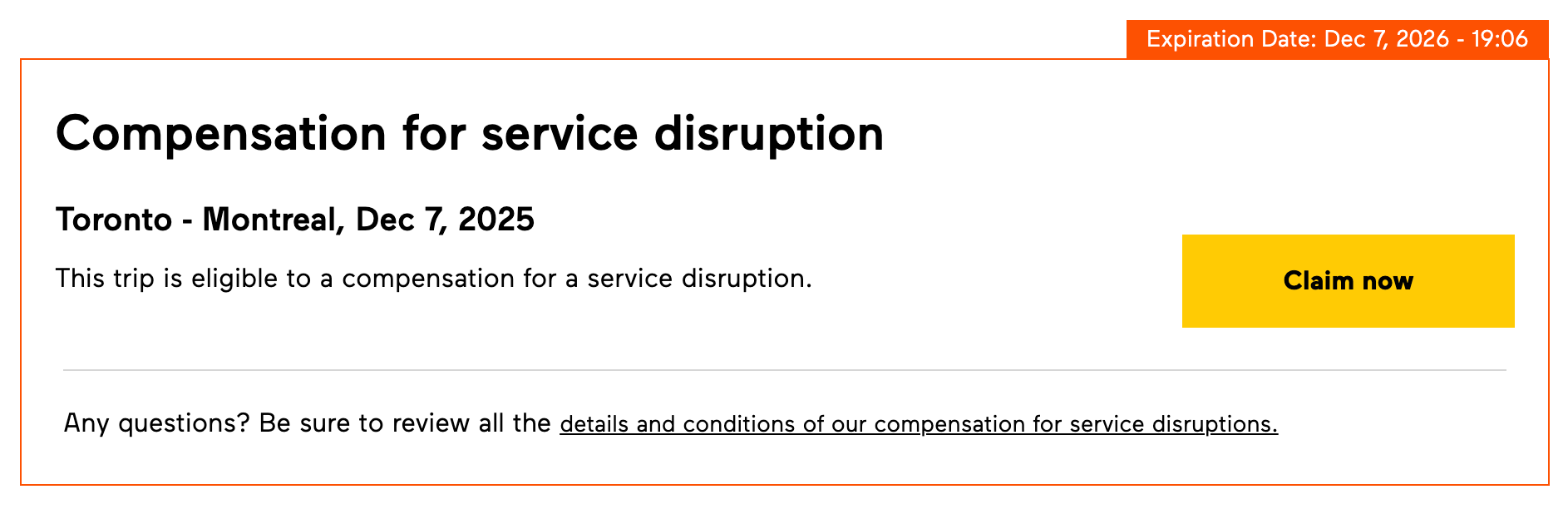

We finally boarded the train, and an hour into the trip, the train got immobilized and a ground hostess (is this the right term for the air hostess that works in trains?) told everyone over the intercom they would be compensated 50% of the value of the train ticket in the form of a voucher!

So earlier today, I actually checked my email and filled the form to get my $59.73 voucher…

There are no laws forcing VIA Rail to compensate their passengers for delays, but it’s customary and something everyone should take advantage of. This reminded me about the importance of making sure to ask for compensation every time a flight is delayed, canceled, or even better, overbooked.

Unlike the wild west of train travel, airlines in Canada actually do have laws forcing them to pay up. However, cash compensation here depends entirely on why you are delayed. If the airline admits the delay is within their control, you can get between $400 and $1,000 depending on the length of the delay. But there is a massive loophole called "safety." If they claim a mechanical issue, they often don't have to pay a dime.

If you are flying to Europe, the rules are much friendlier. They don't care as much about the "safety" excuse, so a mechanical breakdown is usually considered the airline's problem to fix. This means you are much more likely to see actual money rather than just an apology.

If reading all this gives you a headache, you can just use a service like FlightClaim.ca to fight the battle for you. They take a 30% cut of the winnings, but it is better to get 70% of something than 100% of nothing.

Ironically, the best scenario is an overbooked flight where you can legally get "bribed." If they need volunteers, it is a negotiation. Don't take the first offer. I have seen people walk away with huge sums just for taking a later flight.

P.S. I’m switching to sending the newsletter every two weeks so I can focus on building the MooseMoney empire :) If you miss me in the mean time, feel free to come hang out in the MooseMoney Subreddit.

Julien Brault, aka JB, Co-Founder of MooseMoney.com

Recently published on MooseMoney.com

Can You Make Money on OnlyFans in Canada? I Talked to Two OF Models to Find Out

I Tested 4 Different Canadian Credit Score Apps and Here Are The Ones I Will Keep On My Phone

I Did The Math And Here Are The Top Free Credit Cards For Canadians Earning $60,000 or Less

Get free food with Mary Brown's Chicken's 12 Days of Giveaways

If you’re looking for a fun (and tasty) holiday freebie streak, Mary Brown’s is running its 12 Days of Giveaways promotion right now, offering a new free item every day through December 17.

The daily deals can only be claimed through the Mary Brown’s app, and each offer is available for one day only, with the discount automatically applied at checkout. For example, on December 10, which was Day 5 of the promotion, customers could get a free small Taters, normally priced at $3.79. Day 6 was 6 free buscuits. Once the day passed, the freebie disappeared and a brand new one took its place.

If you’re already grabbing lunch during the week or just love trying your luck with daily surprises, it’s worth checking the app each morning to see what free treat Mary Brown’s is giving away next.

Source: RedFlagDeals

Barry Choi: Why You Should Give Cash & Gift Cards This Year

If you haven’t started holiday shopping yet, you probably missed the Black Friday deals, which might be a blessing. Sure, sales can save you money, but they also tempt you to spend more than you planned.

Personally, I’m not big on “stuff.” These days, gifts between my wife and me are practical things we’d buy anyway. She recently got me a dress shirt I picked out myself. I got her coffee pods - or at least I think I did. One day, she told me she ordered her Christmas present from me on Amazon, and coffee showed up the next day.

When it comes to my daughter, though, gift-giving has spiralled out of control. She gets presents from us, still believes in Santa, and receives gifts from grandparents, her uncle, and even family friends. Between birthdays and Christmas, she easily racks up at least ten gifts each time.

Here’s the problem: she only plays with a few before forgetting the rest. We end up donating the rest, which is good, but not ideal.

This year, we’ve taken a different approach. We’ve asked friends not to buy her physical gifts. Instead, we’re telling them that my daughter prefers cash or gift cards for things she actually enjoys, like McDonald’s, Cineplex, or online games. That way, she gets something she’ll truly use.

We’ve also simplified our own gift-giving. Kids get cash, friends get gift cards. It’s practical, stress-free, and saves us the headache of hunting for the “perfect” present.

Cash is especially versatile. Recipients can spend it right away or save it for something bigger. My daughter, for example, insists she’s saving hers for a vacation. I suspect she’s playing me, since I foot the bill when we travel, but at least she’s thinking ahead.

For adults, gift cards are equally useful. They can treat themselves or even re-gift if they choose. Either way, it saves them money, which is the real point.

Some argue cash isn’t meaningful, but that’s nonsense. Everyone’s financial situation is different, and you never know what someone might need. Whether it’s buying a treat, paying down debt, or saving for a home, cash is the most practical gift you can give.

This guest post was authored by Barry Choi, an award-winning personal finance expert who specializes in credit cards and loyalty points.

Earn $500 in cash with TD’s Chequing Account Offer for New Customers

Until March 3, 2026, you can earn $500 cash for opening a chequing account with TD Canada Trust. Here’s how it works. Open a TD Unlimited Chequing account and complete two of the following by May 5: Receive a qualifying direct deposit (e.g., payroll deposit), set up a recurring preauthorized bill payment, or make an online bill payment. The $500 cash will be deposited into your account 12 weeks after you fulfill the offer conditions. You can actually get up to $750 in value by doing other things, like opening a savings account and an eligible credit card.

Is there a catch? Kind of, but not really. The account you have to open is the TD Unlimited Chequing Account, which offers unlimited transactions, free Interac e-Transfers, and no TD ATM fees across Canada, but it has a monthly fee of $17.95. That’s an expensive account, but you can always close the account or downgrade to a cheaper plan after you complete the offer and receive your cash. By the way, TD isn’t the only big bank with a chequing account offer right now. RBC and BMO are offering $400 cash, and other banks have offers, too, so check them out and choose the one you like best.

Source: RedFlagDeals

Financial Calculator of the Week

A consumer proposal can significantly reduce your debt while avoiding bankruptcy, but the amount you'll repay depends on multiple factors. Use this calculator to see exactly what a consumer proposal will cost you, how much you'll save, and whether it makes financial sense for your situation.

Here's an app that can help you save money on food and groceries, according to Reddit users

I was reading a Reddit thread about affordable food options when I stumbled on a comment raving about the Too Good To Go app, and it immediately caught my attention. The Redditor explained that they’ve saved a surprising amount on groceries and takeout by grabbing “Surprise Bags” from local bakeries, cafés, and restaurants. These bags are filled with perfectly good food that would otherwise go to waste and are sold at a steep discount. They liked that it was not only cheap but fun, too, since you never quite know what you’ll get. They said it’s become part of their weekly routine and has helped them stretch their food budget significantly.

Of course, we've covered Too Good To Go and other expired food apps here at MooseMoney and found some solid food-saving options. I rechecked it this week after reading the Reddit comment and found a Chinese food Lunch Surprise Bag for $5.99, A 7-11 Surprise Bag with an assortment of day-old baked goods for $3.99, and a Surprise Bag from a Filipino restaurant that said it was "filled with delicious Filipino food" for $6.99 (listed value was $21.00)!

Too Good To Go is great, but just be reminded that you need a credit card to purchase food in the app. Otherwise, it's an excellent tool for anyone looking to save money while reducing food waste.

Source: Reddit

For a limited-time, get a $60 bonus* when you sign up for any Neo card!

From fast approval to everyday rewards, the Neo Mastercard pays you back. Literally. Plus, get instant access to your virtual card as soon as you're approved so you can start spending and earning right away.

* Limited-time offer. Only valid for new Neo customers who open their first eligible Neo credit product and make a purchase within 90 days. Limit of one offer per customer. Offer is subject to the Neo Rewards Policy and may be amended or cancelled at any time without notice.

Loyalty points at risk? Here's why you shouldn't wait too long to use your reward points

There’s growing concern in Ontario after news that the provincial government is considering changes that could affect loyalty reward point expiry rules. While nothing has officially changed yet, the discussion is making people nervous about having expiry dates slapped onto the points they’ve worked so hard to earn. The reality is that companies already have a lot of control over how their loyalty reward programs work, and even if expiry rules don’t change, companies can still reduce the value of points or change redemption options with notice. That means you could wake up to find your points aren’t worth what they used to be, or you may not have enough time to redeem them the way you planned.

It’s a good reminder that no matter where you live, hoarding points is risky! Rewards programs can change terms, devalue points, or introduce new restrictions at any time. If you’ve been meaning to cash in for travel, gift cards, free groceries, or statement credits, you’re usually better off redeeming sooner rather than later. Points aren’t savings accounts, and the longer you hold them, the more you’re exposed to changes you can’t control.

Source: InsideHalton.com

Side Hustle Of The Week: Pet Sitting!

Ever thought about getting paid to hang out with other people’s pets? Pet sitting has quietly become a reliable side hustle for Canadians who love animals and want to earn extra income on a flexible schedule.

This week’s story comes from a Reddit user who brings in between $700 and $1500 a month doing in-home pet sitting. She picks up overflow work from a retired woman who built her client base years ago while cleaning houses. Once people realized she was trustworthy, they started asking her to look after their pets, too. Our Redditor enjoys staying in nice homes and caring for well-behaved pets. She sets firm boundaries by declining clients with unsafe homes or animals that aren’t a good fit.

She’s divorced, child-free, and works remotely, so the job blends smoothly into their lifestyle. Many clients choose in-home sitters because they have multiple dogs or older pets who struggle with boarding, but you can find clients who will bring their pets to you. Others in the same Reddit thread mentioned similar experiences, earning anything from a couple thousand dollars a year to running a niche business caring for dogs who don’t get along with others.

How Pet Sitting Works

Pet sitting is similar to house sitting, but focuses on caring for pets while the owner is away. Sitters can offer overnight stays, daily visits, or one-pet-at-a-time care from their own home. To get started, you can join a platform like Rover or TrustedHousesitters, or begin locally by offering your services to friends, neighbours, or on local Facebook communities.

Source: Reddit

🚨🏷️ Moose on the Loose in Dealville

Dominos Emergency Pizza

FREE with purchase of $10 or more

Want a free pizza? Here’s the scoop: Place an order for $10 or more online from Domino’s by January 4, 2026, and voilà, you qualify for a FREE Emergency Pizza (a medium, two-topping lifesaver). It's added to your Domino’s Rewards account, ready to redeem later when dinner plans fall through. Burnt food? Unexpected guests? Moosey-approved solution: deploy emergency pizza and save the day (and your wallet)!

Kraft Stove Top Turkey Stuffing

$0.97

I've sniffed out a classic comfort food deal, just in time for the holiday season! Kraft Stove Top Turkey Stuffing is the cozy, savoury sidekick your Christmas dinner’s been waiting for. Just add water and butter, and boom, you've got fluffy, herby stuffing magic in minutes. It's rare to see this product on sale for less than a dollar. That's 60% off!

Sport Check 10 Skate Sharpenings

$49.98

Here's a puck-lovin’ steal of a deal! Snag a 10-sharpen skate card that you can redeem at any Sport Chek location. There's no expiry date, so you can use this the entire season on different pairs of skates and keep those blades bite-ready. That’s 10 pro skate sharpens without paying each time, saving you serious loonies over walk-in prices. Perfect for regular skaters or anyone who hates dull edges and extra fees!