Most people don’t actually know how a cash advance works or how much it costs. I decided to stop the guesswork and test it myself. So, I took not one but two cash advances. One from my PC Mastercard, and the other from my Tangerine Money Back World Mastercard.

I learned several things from this experiment. Interest is charged immediately upon withdrawing the funds. There is no 21-day interest-free period for cash advances, and there are surprise fees. The minimum monthly payment is an expensive trap. But most important of all, how the credit card issuer calculates the minimum payment has a dramatic impact on your financial wellness.

The only way to understand the true cost was to do it myself and crunch the numbers. I withdrew $100 from each credit card. Here’s how much it cost me, and how much it could have cost me.

The First Cash Advance: PC Mastercard

Purchase Interest Rate: 21.99%

Cash Advance Interest Rate: 22.97%

Cash Withdrawn: $100

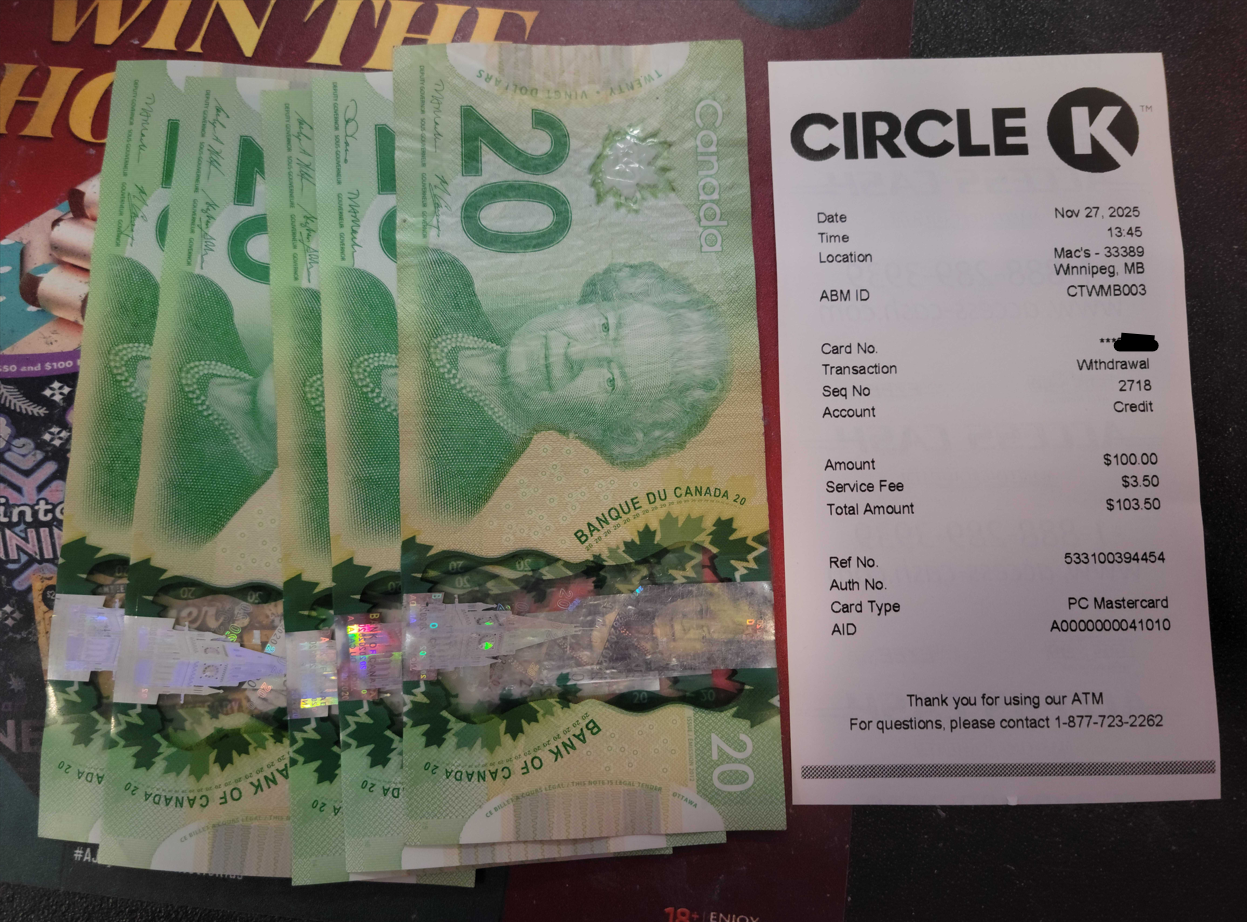

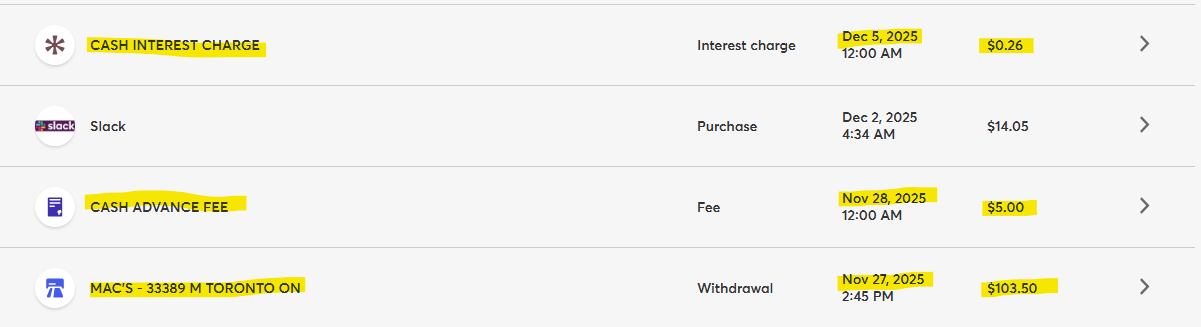

ATM Fee: $3.50

Cash Advance Fee: $5.00

Term: 4 days

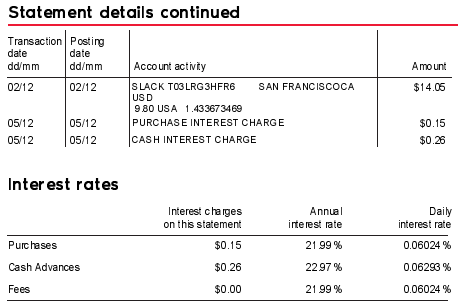

Total Interest: $0.26

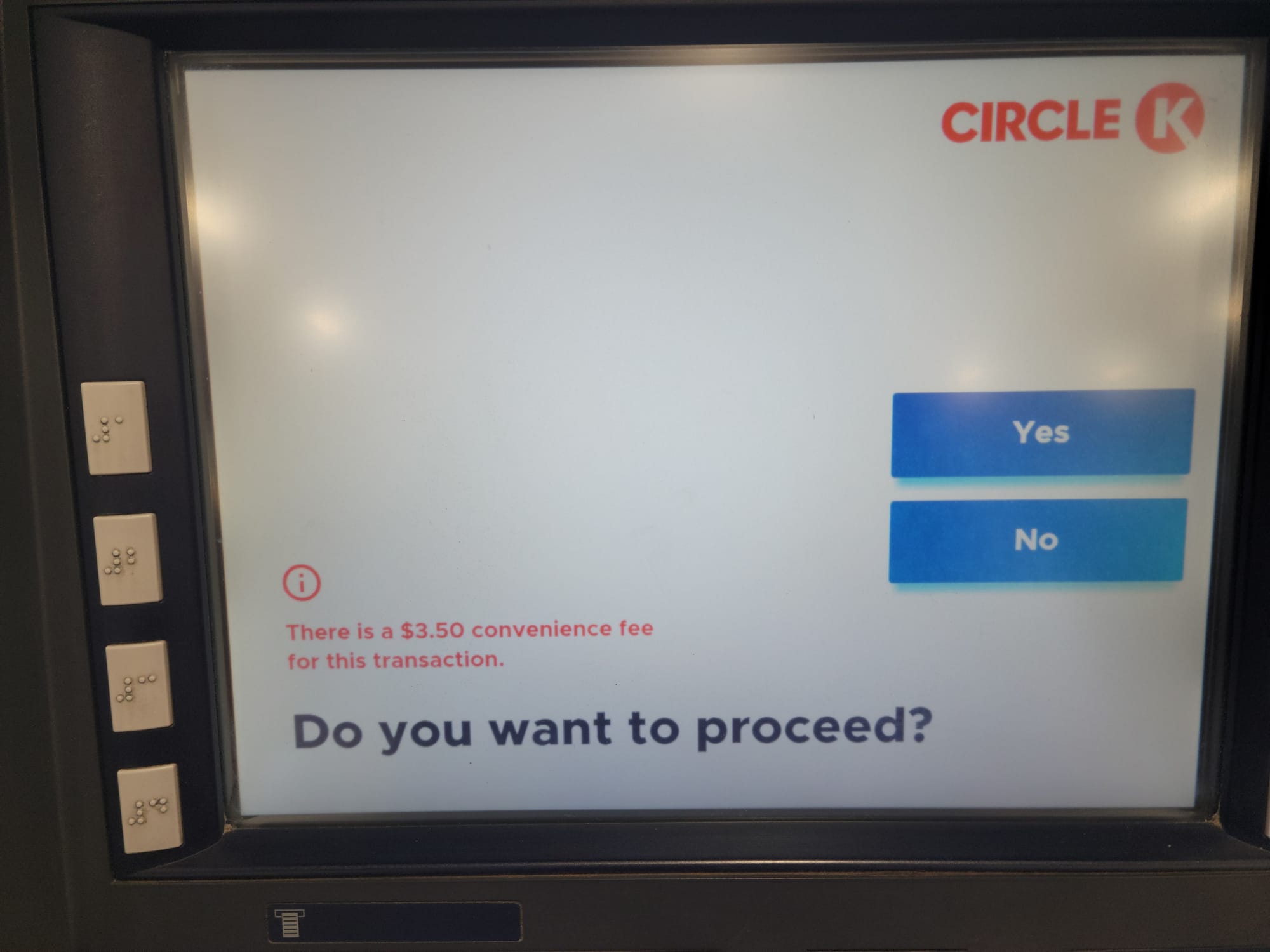

I took the first $100 cash advance off my PC Financial Mastercard on November 27th, 2025. I live next door to a Circle K convenience store, so it took about 2 minutes to walk over and use their ATM.

The machine charged me a $3.50 service fee. I knew it was coming, but I still cringed. A few days later, I logged into my credit card account to check the transaction history when my flabbers were gasted! PC Financial charged me a cash advance fee of $5. I had no idea this charge was coming, and it completely caught me off guard. But alas, when I checked the disclosure statement, the fee was there in black and white.

So far, this $100 cash advance cost me $8.50 in fees alone. And we haven’t even gotten to the interest yet.

I kept the cash advance for 4 days. The interest came to $0.26. That doesn’t sound like much, but stay focused. The point is that it grew every single day, starting from the moment I pulled the cash out of the machine.

Remember, cash advances never get the interest-free grace period that regular purchases do. Things like groceries, gas, your Netflix subscription and your bestie's birthday present get a three-week head start before interest accrues. But a cash advance earns interest the second you press the withdrawal button.

My PC Financial Mastercard charges 21.99% on regular purchases and 22.97% on cash advances. A higher cash advance rate is a standard credit card feature.

When I checked my transaction history, I got annoyed. I expected to see interest charges applied to my account in real time, but they weren’t there. Apparently, that’s not how this works. Credit card companies often apply total interest charges on a specific date each month, usually just ahead of the statement cutoff date.

I wanted answers faster, so I tried contacting PC Financial through the online chat feature. It refused to connect me with a live agent and forced me to create a ticket instead. I asked for the interest calculation and the formula so I could do the math myself. At the time of writing, I still have not heard back.

Eventually, the interest charge did show up on my account. My PC Financial Mastercard statement runs from Nov. 7, 2025, to Dec. 6, 2025. My cash advance interest charge was applied on the 5th, the day before the statement cut-off date.

Cash Advance Two: Tangerine Money-Back World Mastercard

Purchase Interest Rate: 20.95%

Cash Advance Interest Rate: 22.95%

Cash Withdrawn: $100

ATM Fee: n/a

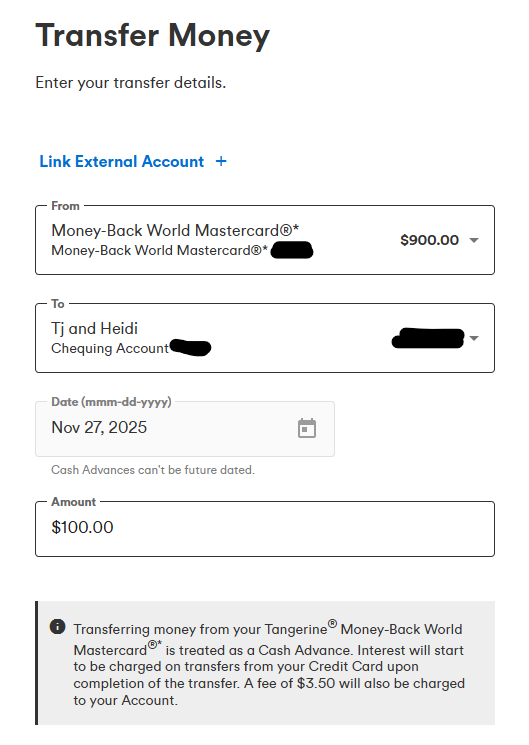

Cash Advance Fee: $3.50

Term: 5 Days

Total Interest: $0.31

Next, I took a second cash advance from my Tangerine Money-Back World Mastercard. This time, I wanted to avoid the ATM fee. Since I bank with Tangerine, I transferred $100 from my credit card straight into my chequing account. Clever right? Lol, nope. Tangerine charged me a $3.50 cash advance fee anyway. Same price as the ATM fee, but lower than PC Financial’s charge. A win is a win, I guess.

I held on to this cash advance for 5 days. The interest came to $0.31 cents. Again, the interest did not show up on my credit card transaction history in real time. So I used Tangerine’s chat feature and was able to connect with a live agent. He confirmed the interest amount and gave the exact formula so I could calculate future interest charges myself. He was super helpful. I gave him a 5-star review and told him to ask for a raise. Here’s the formula:

Interest = (Balance) x (Interest Rate) x (Number of Days) ÷ 365

My Tangerine card charges 20.95% on regular purchases and 22.95% on cash advances. Again, it’s standard industry practice to charge a higher rate for withdrawing cash.

Why the Minimum Payment Makes Cash Advances SO Expensive

The biggest trap is the minimum payment. One in three Canadians is carrying a balance on their credit cards month to month. Many of them are only making the minimum payment because it feels manageable. But minimum payments are exactly how a small cash advance balloons into an expensive, long-suffering debt.

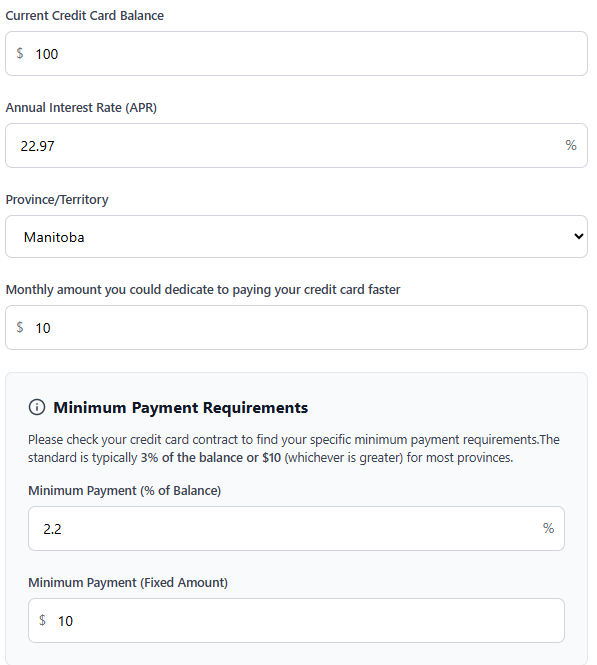

Each of my credit cards calculates minimum payments differently. My PC Mastercard charges 2.2% of the balance, or $10, whichever is more. That’s pretty standard for most cards on the market.

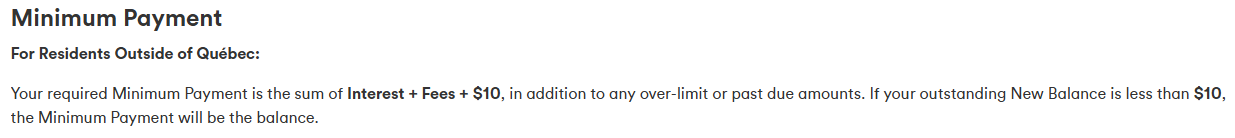

But my Tangerine Mastercard uses a different formula entirely. According to the disclosure statement, it charges the sum of interest and fees, plus $10. It does not use a set percentage of the balance.

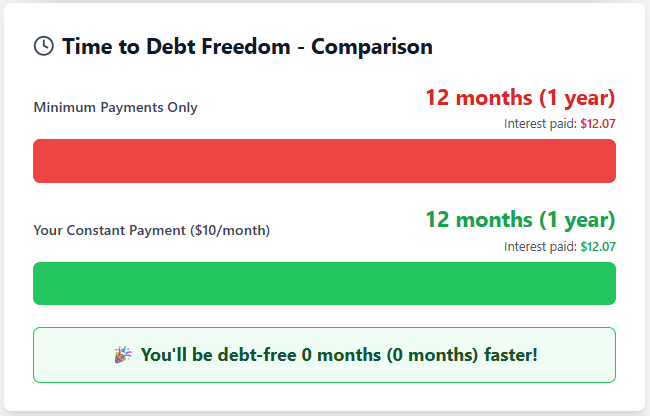

To see how long it would take to pay off my PC Mastercard cash advance by making only the minimum payment, I plugged the numbers into the Moose Money credit card minimum payment calculator.

For the PC Mastercard, I entered a balance of $100.00. I used the cash advance interest rate of 22.97% and set the minimum payment to 2.2%, which is the minimum payment calculation rate given in the disclosure statement. The calculator said it would take me 12 months to pay it off, and I’d pay a total of $12.07 in interest. Add the fees and interest together, and that $100 cash advance actually ends up costing me $20.57.

Why I Had to Build My Own Amortization Schedule For the Tangerine Mastercard

Tangerine’s minimum payment formula is so wild that online calculators can’t even figure it out. Almost every credit card on the market uses a simple percentage of your balance. But Tangerine doesn’t follow that structure at all. Remember, it uses the sum of interest and any fees you owe, plus $10.

Minimum Payment = Interest + Fees (if applicable) + $10

That means for every minimum monthly payment you make, only $10 is applied to your balance each month. The rest of your payment is going straight to interest.

I couldn’t use the Moosey Money credit card payment calculator for this, because no online calculator can handle that kind of witchcraft. I had to build my own amortization schedule in Google Sheets.

An amortization schedule is just a month-by-month breakdown of how a debt shrinks over time. It shows how much interest you pay, how much of your payment goes to the principal versus interest, and how long it will take to reach a $0 balance.

By using Tangerine’s formula, I could finally see the time and accumulated interest for my $100 cash advance. Making only the minimum payment, it would take 10 months to pay off and cost me $10.52 in interest. Add in the $3.50 fee, and the total cost of credit is $14.02.

A small $100 cash advance doesn’t seem so bad. It’s low enough that most of my payment is applied to the balance, and very little to interest. But real life comes with financial emergencies much higher than $100. What if I need to withdraw a few thousand dollars? According to TransUnion, nearly half of all Canadians carry a credit card balance, and the average amount owing is $4,562.

When I plug those numbers into my spreadsheet, the math looks absolutely criminal. It would take me just over 38 years to pay off $4,562 on my Tangerine, and it would cost me $19,944.93 in total interest. I can’t even include a screenshot of the spreadsheet because it takes up 457 rows!

But my PC Mastercard is actually even worse, which surprised me. Remember, it calculates my minimum monthly payment as 2.2% of the balance or $10 (whichever is higher). So a $4,562 balance on that card would take just over 76 years to pay off and cost $28,128.56 in total interest.

Hold up, why the huge difference between cards?

The Shocking Thing I learned From This Experiment

I was mindblown to discover just how much the minimum payment formula matters. Tangerine charges interest first, then adds a flat $10. The sum is your minimum payment. That means every payment guarantees a fixed $10 reduction in principal. Which means, over time, more and more of your minimum payment goes towards the principal.

PC Financial uses a percentage-based minimum that’s 2.2% of your balance, or $10, whichever is more. The dollar amount of your monthly payment adjusts as the balance changes, but the portion applied to the principal is not fixed. Early on, payments appear larger, but as the balance falls, the minimum payment shrinks as well. Over time, less and less of each payment goes towards reducing the balance.

That difference in payment structure is what leads to dramatically different payoff timelines.

The smartest move is to avoid cash advances and never carry a balance. Build savings when things are calm so you’re not forced into high-cost options when shit happens. And if you ever do take out a cash advance, pay it off fast. “Don’t put off until tomorrow what you can do today,” (Benjamin Franklin, probably). Your wallet will thank you.