Debt collectors will say anything to a debtor, but nothing to a journalist.

I spent weeks trying to get one, anyone, to talk to me. I cold-called agencies over and over and over again, ad nauseam. I was brutally rebuffed every single time. I slid into LinkedIn inboxes like a desperate ex. Not a single debt collector replied. The silence was deafening.

As my deadline approached, I hit up my personal and professional networks, begging for introductions. Even then, the collectors I did connect with only agreed to talk under strict conditions. No real names, and no company details. One person even attempted to back out after the interview, essentially trying to go off the record retroactively.

Did you know that no matter what your credit score is, you can get instantly approved for Secured Neo Mastercard? Plus, sign up now via the button below and get a $60 welcome bonus.

* Limited-time offer. Only valid for new Neo customers who open their first eligible Neo credit product and make a purchase within 90 days. Limit of one offer per customer. Offer is subject to the Neo Rewards Policy and may be amended or cancelled at any time without notice.

Honestly, I wasn’t surprised. I worked in finance for almost ten years. Five of those years I spent working for a subprime lender. Agencies record every call, collectors have insanely high performance targets, and their base pay is peanuts. Taking time out to talk to me meant missing quotas, losing commission, potentially losing their job, or inciting a lawsuit.

But I stayed the course. I needed to know: when do debt collectors stop calling? What does it take for them to actually give up the chase? To answer that, I spoke with two debt collectors, an insolvency trustee, and a borrower who showed me her collection emails.

The Veteran: 45 Years of Collecting (Without Crossing the Line)

I promised him anonymity, so let’s call him The Veteran. He spent nearly half a century in the business, and his agency specialized in consumer accounts ranging between $3,000 - $5,000. He didn’t collect for the banks. His meal ticket came from mid-market industries like utilities, HVAC, and car rental companies (to name a few).

Unlike the infamous stereotype, his collectors weren’t snarling into phones or hurling threats like cartoon villains. Those strategies were, and still are, against the rules. But more importantly, they just weren’t effective.

His most profitable collection strategy? A diabolical concept called ‘Empathy’. He found the best way to get people to pay was twofold. First, treat them with dignity and respect. Next, design a custom repayment plan.

While other, less profitable agencies were demanding full payment, The Veteran was negotiating settlements between 50-80% of the balance. And if that didn’t work, he offered a manageable repayment plan the person could actually afford.

“We had an empathetic, goodwill approach where we worked with the debtors,” The Veteran explained. “A lot of collection agencies have a culture of demanding full payment up front. We recognized that there's a point where someone owes $5,000 or more, full payment is not realistic.”

Passive-Aggressive Pays Off

When all else failed, The Veteran whipped out his favourite collection tool: the credit bureau. Instead of calling the debtor daily and actively trying to collect, he would report the delinquent account to Equifax and TransUnion, negatively impacting the debtor's credit score.

And there it would sit until it was paid or the standard reporting period expired. He explained this was effective because people eventually needed to fix their credit to qualify for big purchases like a car or a mortgage. Once paid, it would be reported as either paid in full or a settlement made.

So at what point would he finally give up? “After about a year of intermittent collection efforts, we had a few options: return the account to the client, close it as uncollectible, or keep it in our system,” said The Veteran. “We preferred keeping it in the system, because reporting the debt to credit bureaus was the best collection tool."

The Craziest Thing He Ever Heard

But even with all that empathy, no good deed goes unpunished. When The Veteran’s agency handled calls for a major U.S. client, the tone shifted dramatically. American debtors, he explained, were far more hostile than Canadians. The threats were shocking.

“I’m going to kill you,” “We’re going to shoot you.” It wasn’t a daily occurrence, but it happened enough that it left a lasting impression. He chalked it up to the gun culture south of the border, a level of aggression he simply never encountered from Canadian debtors.

Jay Describes Life on the Phones

Jay works for one of the Big Five banks. Before his recent transition, he spent nearly 20 years in the trenches of almost every major collection agency in Canada. His job was primarily collecting for banks and financial institutions.

Jay says banks rarely sell debt outright. But after 90-120 days of delinquency, they hire collection agencies, like the ones he worked for, to collect on their behalf. That’s when the phone marathon would start, and survival meant hitting quotas that would make your head spin. We’re talking targets of nearly 300 calls a day, with collection quotas of over $170,000 a month per agent.

The odds were not stacked in his favour. Out of 250 calls, Jay said roughly seven debtors would answer. Entry-level collectors earned minimum wage with targets that felt impossible. Miss them and you risk getting fired. If you wanted a decent income, you had to consistently exceed targets.

After years of grinding in one of Canada’s most expensive cities, it took Jay almost 14 years to finally achieve a six-figure income. The slim chance of big money was enough to keep some collectors chained to their desk, headset on, overcaffeinated and stressed as hell.

His Best Collection Strategy

While some agents tried to berate debtors into submission, Jay found his bread and butter in a much softer approach. Relatability. If he was talking to a student or young adult, he’d say “hey man, I was in a lot of debt too when I was your age.” If he heard a baby in the background, “I have a baby too. Diapers are so expensive!” Spoiler alert: Jay does not have any children.

“The trick was speaking to them in the middle, not above or below them,” Jay says. For people with a steady job, he worked to negotiate a settlement agreement, which meant paying a portion of the balance with a single lump sum payment in exchange for having the rest forgiven.

Repayment plans, a series of smaller payments over a defined period of time, were offered rarely and selectively. Offering too many would prevent him from hitting his targets. And because payment plans were generally unprofitable, the agency risked losing the client.

Burning the File

Every collector has their own ‘style’ that works for them. For some, that meant going full scorched earth, verbally assaulting debtors until they hung up or broke down. Jay said that the approach sometimes worked, but you risked losing the debtor forever. In industry slang, that’s called ‘burning the file’. Once burned, it was basically impossible to collect. Plus, it’s against the law.

So why did some agents go nuclear? Jay blamed the pressure cooker environment. Insane daily quotas, commission-based pay, and constant turnover pushed collectors to the edge. A few crossed the line, sometimes they got fired, but most just quit.

When Jay Finally Gives Up

After three to five years, Jay says debts become much harder to collect, especially when it’s past the statute of limitations to sue. At that point, agencies often settle for whatever they can get. Sometimes that’s as little as pennies on the dollar.

In his experience, the original creditor, like a bank or retailer, still owns the account. They just pass it between agencies like a hot potato. That’s why you can get different agencies chasing the same account over the years.

So at what point would he finally give up the chase? Jay said there was no hard and fast rule. It was on a case-by-case basis. The debtor either had money or they didn’t. That’s when he’d make what he calls a “logical decision.” If the debtor was broke, unemployed, or unable to pay, he’d stop chasing. But if he could “smell money” like a steady job or signs of income on the credit file, he would keep the pressure on.

He would back off pensioners and those on disability income much quicker. “We knew we couldn’t garnish pensions, so it didn’t make financial sense to sue seniors.”

Robo-Calls, Emails, and Traps

What about those robotic “this is an important call about your account” voicemail messages? Collectors hate them, too. Jay said robocalls are “useless” because there’s “no ability to negotiate on an automated call.”

These types of notifications are most likely to come from the original creditor in the early stages of delinquency, he explained. Some creditors allow the agency to send emails and texts, but they have to use pre-approved templates. Jay believes these touchpoints are effective at getting the debtor to return the call, but only a human can persuade them to pay.

The Veteran admitted his agency found tremendous success with automated calls, emails, and texts. He saw a boost in response rates “because people are more likely to keep their email and phone number updated compared to their mailing address.”

An email seems innocent enough. Right?

This Debtor Has the Receipts

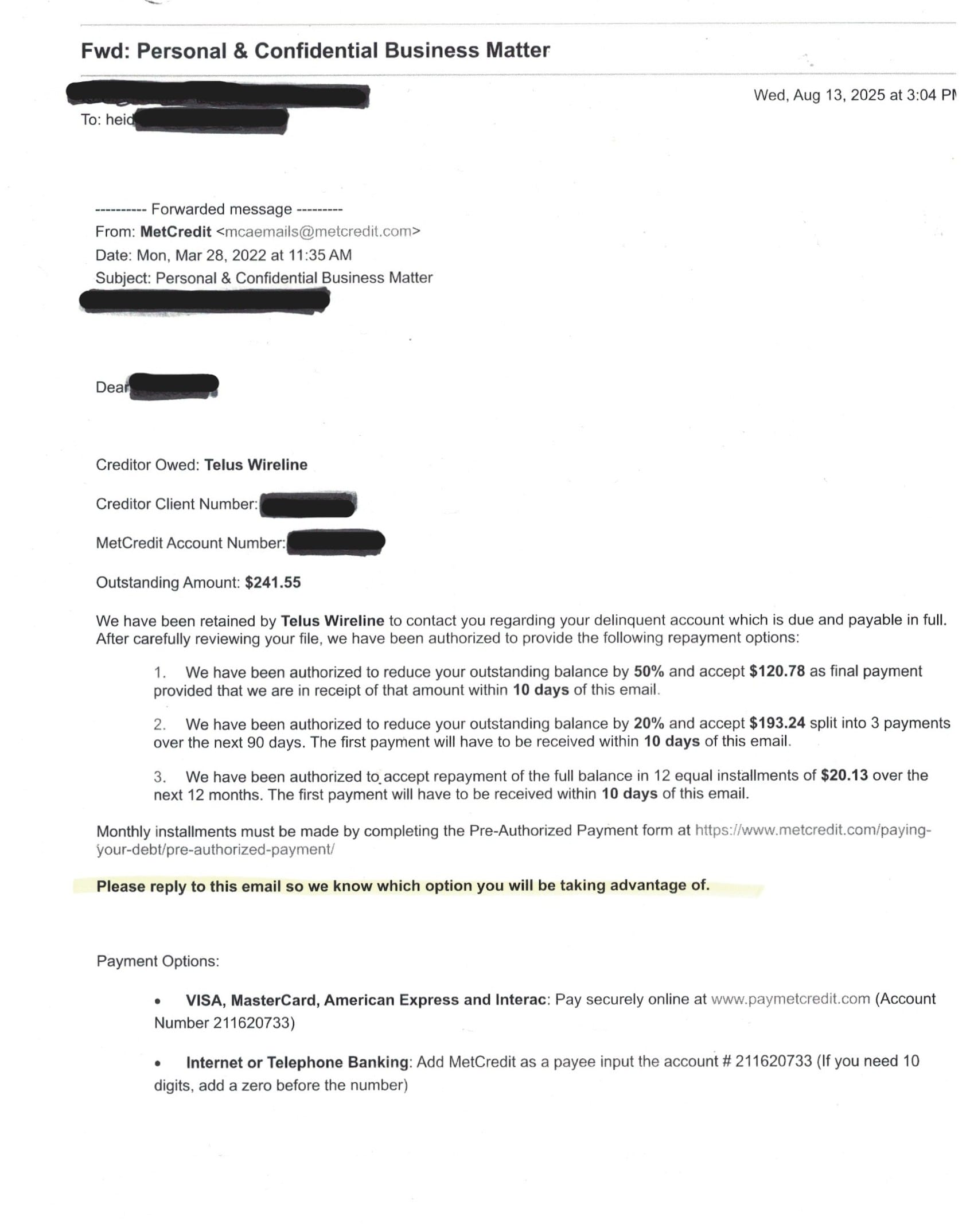

Take this MetCredit letter sent to Jules M. On the surface, it looks professional and non-threatening. The outstanding balance is neatly itemized, and multiple payment options are offered. There’s even a polite request to “reply to this email so we know which option you will be taking advantage of.”

But that’s where they hook you. If she typed back, “Oops, my bad! I’ll take the payment plan,” she would have acknowledged the debt in writing and made a payment. If the statute of limitations hadn’t already expired, she would have instantly reset the two-year deadline to sue in Alberta. Suddenly, a debt that was just about to lose its legal bite would be revived.

Look closely, there is NO number to call. MetCredit is betting on the fact that most people don’t know how these statutes work, or that they even exist. Without the ability to sue, collection companies lose their leverage. They no longer have the court on their side.

So what rights do you actually have when the calls, emails, and letters are relentless?

I Asked a Licensed Insolvency Trustee

Scott Terrio sat down with me to set the record straight. As a Licensed Insolvency Trustee with Hoyes Michalos, Scott spends his days walking people through bankruptcies and consumer proposals. He explained that a statute of limitations is the legal deadline a creditor or collection agency has to sue you for an unpaid debt.

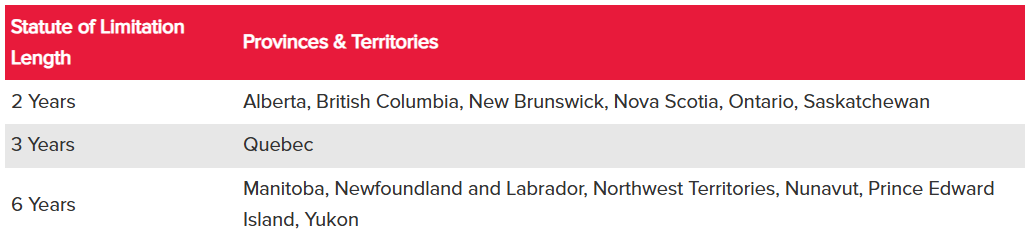

Every province sets their own time limit. In Ontario and Alberta, it’s two years, Quebec is three, and in Manitoba (where I live), it’s six years. Once that deadline passes, collectors lose the legal right to sue. “Collectors can hound you, but they can’t actually see a lawsuit through to its conclusion,” Scott explained. “They can’t successfully garnish your wages or freeze your bank account.”

Source: BDO Debt Solutions

The Six-Year Shadow

But even when collectors can’t take you to court, the debt still haunts your credit report for six years after the last activity on the account. That black mark is enough to pressure most debtors to pay up, especially if they want to qualify for new credit down the road. Remember, it worked for The Veteran

Restarting the Clock

Scott, the insolvency trustee, was clear about one of the most insidious traps. You can unwittingly revive an oldish debt. The statute of limitations can only be reset if there is still time left on the clock. It cannot be restarted once the limitation period has fully expired. But if the debt is still within that window, two things can set it back to day one:

- Making a payment

- A written acknowledgement that you owe the debt

He says verbal conversations absolutely do not count, no matter what Reddit and TikTok say. “Talk is cheap in this regard,” he said with a chuckle. They can record your voice admitting the debt is yours ‘til the cows come home, the court does not care. “It has to be in writing that you acknowledge the debt for the clock to restart.”

But the most insidious myth Scott wants to debunk is this:

Asking for proof of the debt absolutely will not restart the clock. Debtors have a legal right to request this information. “Asking for proof of the debt is not an acknowledgement. The collector might say it is, but it isn't,” he vehemently stated.

Dodging Calls, Threats, And Lies

And those incessant calls. Can you block them? Change your number? Absolutely. “There’s no legal consequence,” Scott confirmed. The calls will eventually start again, but you’re under no obligation to answer. That said, ignoring collectors won’t stop your credit score from nosediving.

But what about the lies? Scott has heard horror stories from his clients. Threats of deportation, arrest, or going to debtor’s prison. “That hasn’t existed here in 150 years!” Scott laughs. It’s all theatre, designed to scare you into paying.

Agents who behave like this have gone rogue, and you should report them. By law, debt collectors are not allowed to scare you with threats, swear at you, or harass you. They’re also not allowed to badger you nonstop or lie about what might happen if you don’t pay.

Scott, When Do They Give Up?

Eventually. After years of being shuffled from agency to agency, the debt will get an R9 rating on your credit report, which essentially means it's been written off. Eventually, it will drop off your credit report, and the phone will go quiet. But the debt is not actually gone, says Scott. “It’s still accumulating interest. Debt never goes away.”