Virtual credit cards are getting more and more widespread in Canada thanks to their multiple advantages: they can be issued instantly (no need to wait two weeks to receive it in your mail box) and they are as potent as their plastic counterparts, since they can be both used online or in-store, since it's easy to add them to either Apple Wallet or Google Wallet and pay with them using your phone. I wanted to see how that played out in real life, so I tested four Canadian virtual credit cards back-to-back.

But first: What is a virtual credit card, exactly?

A virtual credit card is a purely digital card number, linked to a real credit account (or deposit account in the case of prepaid virtual cards), that you can use for online or in-store purchases without ever pulling out physical plastic. While some are purely virtual, others are just a way for credit card issuers to deliver your card before it arrives in your mailbox in plastic form.

That said, some credit card companies allow you to generate at will single-use virtual cards, that you can use for a specific expense or a website you don't fully trust.

Virtual credit cards come in all shapes and forms. They can be traditional credit card, rewards credit cards, cash back credit cards or even prepaid credit cards, etc. For this article, I opted to apply to four prepaid virtual credit cards, which don't trigger any credit check. (I like my credit score the way it is, thank you very much.)

My goal? To see what it’s like to sign up for each of those virtual cards, verify my identity, add it to my wallet, and actually use it in the real world.

The lineup: Neo Financial, Koho, Wise and Wealthsimple. Here’s how it went, from my smoothest tap to my most hair-pulling verification loop.

KOHO

I started my testing spree with KOHO, curious to see if their playful branding translated into a smooth setup process. Setup took about 10 minutes. I started on my laptop in Chrome, then hopped over to the mobile app. After the usual name/email/password and email verification, I got to pick a virtual card design. I went with a serene sailing scene (hey, if I can’t be on a yacht, at least my virtual card can).

Funding was simple. I linked my BMO debit card, loaded $20, and it appeared in my account within minutes. Security felt solid with quick logouts and two-way authentication. Of all the apps, this one has one of the nicest interfaces with an easy, intuitive layout.

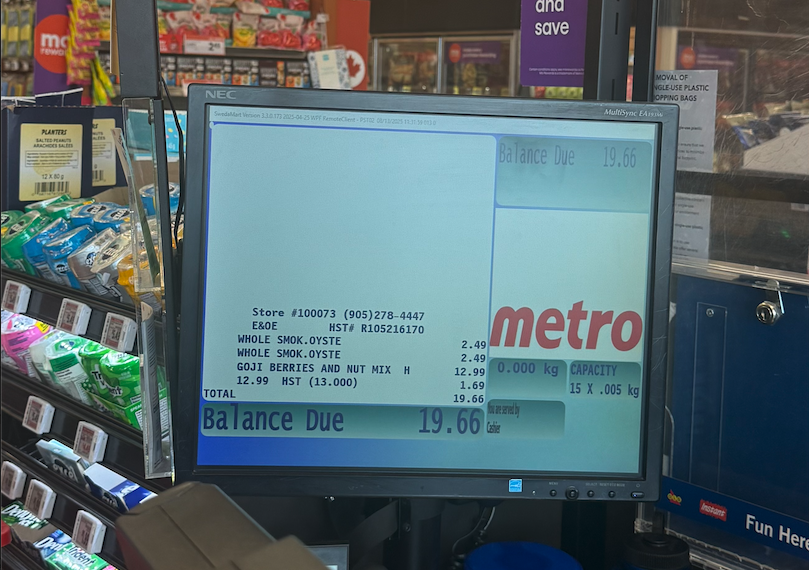

Real-world swipe: I used the Koho card at Metro to buy trail mix and two tins of smoked oysters for $19.66. Despite testing the patience of the people in line behind me and my cashier, the transaction went through instantly, with a purchase notification popping up right away.

Standout facts:

- Card type available: Prepaid only

- Annual fee: $0 (Everything plan is $7/month for extra perks)

- Rewards: Up to 5% cash back with certain merchants

- Currencies: CAD only

Wealthsimple

The account setup was under 10 minutes, and it only felt slower than Koho because there’s a three-to-five-minute “please wait” period while it verifies your information (with no progress bar).

This card is a little different: you have to set up a chequing account first, which I linked to my BMO account, and then verify and fund it the same way as KOHO. The app required a bit of effort to locate the virtual card, but once found, adding it to Apple Wallet was instant.

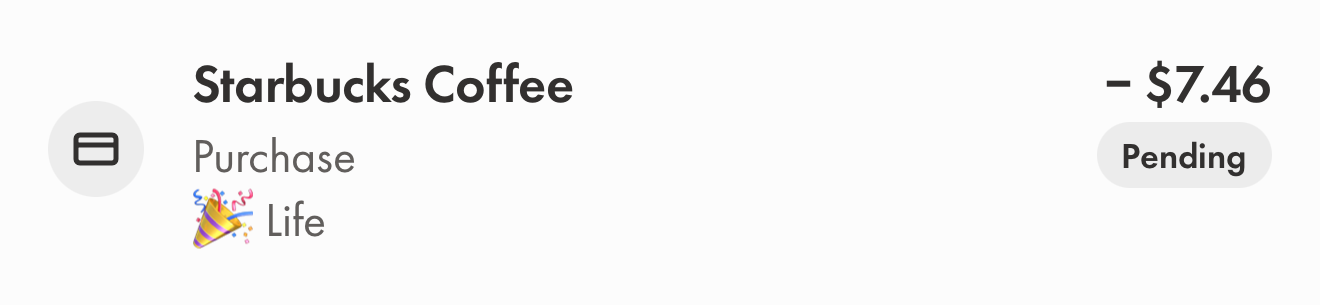

Real-world swipe: This was my first “in-the-wild” tap of the day, and I took it to Starbucks for a Venti cold brew before settling in to write. I tapped my phone, it approved instantly, and seconds later, I got the purchase notification.

Standout facts:

- Card type available: Prepaid & traditional credit cards

- Annual fee: $0

- Rewards: 1% cash back on purchases or 1% stock/crypto rewards

- Currencies: CAD only

Neo Financial

One of the fastest setups I tested: about seven minutes from start to finish. SIN, driver’s licence, a quick video selfie, and I was done. The app is clean, logging in was seamless, and adding the card to Apple Wallet was instant.

Funding was equally painless. I used the “Request Money” feature, sent myself $10, and the transfer was complete within minutes. Honestly, the process was super smooth from start to finish.

For a limited-time, get a $60 bonus* when you sign up for any Neo card.

From fast approval to everyday rewards, the Neo Mastercard pays you back. Literally. Plus, get instant access to your virtual card as soon as you're approved so you can start spending and earning right away.

* Limited-time offer. Only valid for new Neo customers who open their first eligible Neo credit product and make a purchase within 90 days. Limit of one offer per customer. Offer is subject to the Neo Rewards Policy and may be amended or cancelled at any time without notice.

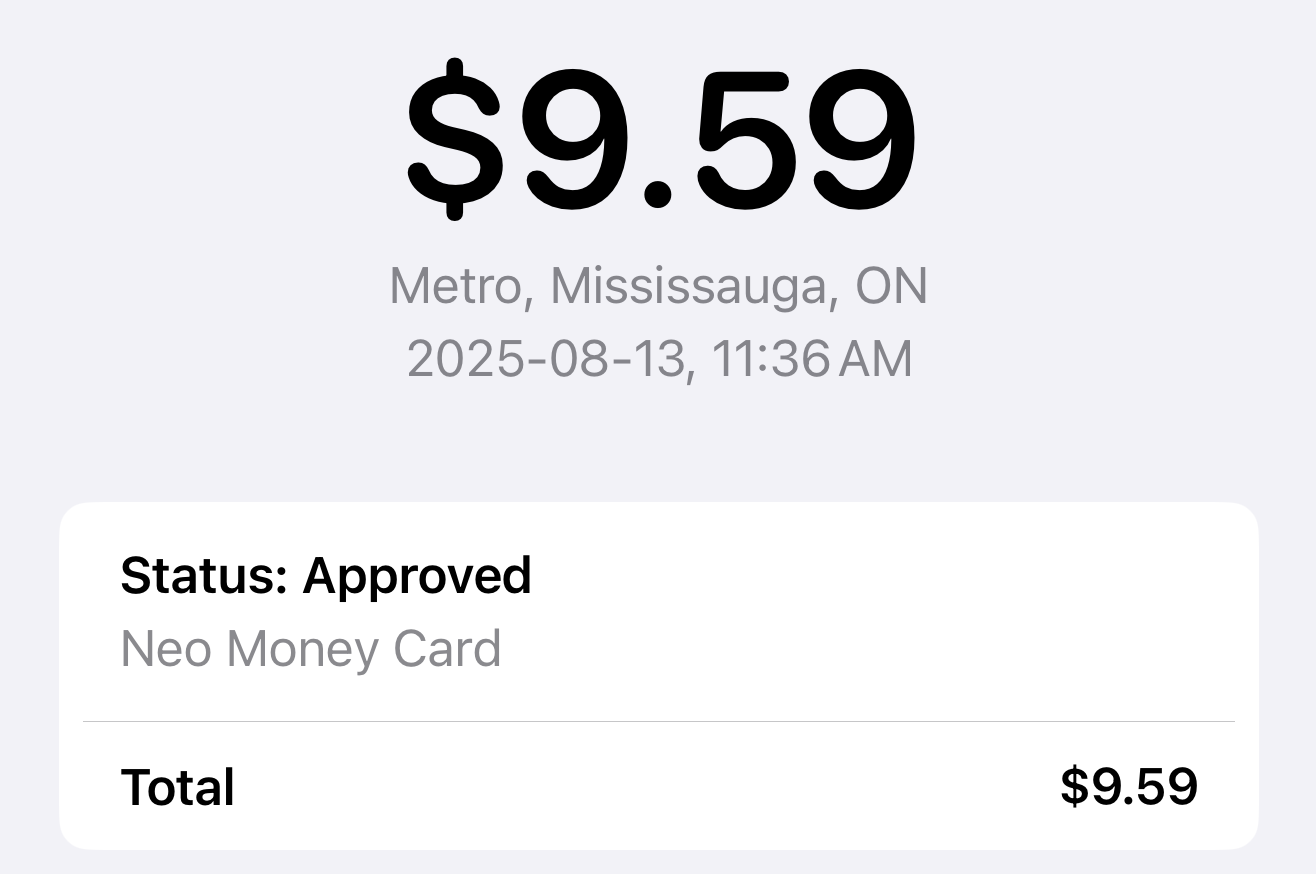

Real-world swipe: I tried the Neo Money card at Metro, buying a Cobb salad for lunch. It went through without any problems, and the purchase notification landed right away. Fun fact: I even made 10 cents in cash back on that $9 salad, as the app later informed me.

Standout facts:

- Card type available: Prepaid & traditional credit cards

- Annual fee: $0

- Rewards: Up to 5% cash back at partnered retailers (like Metro grocers)

Wise

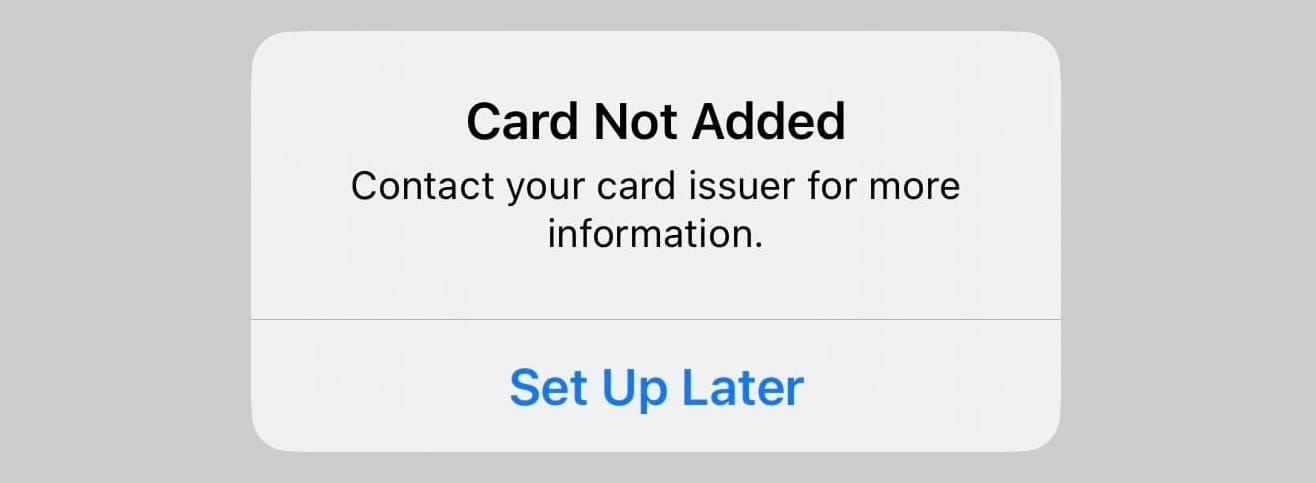

Where Koho, Wealthsimple, and Neo were smooth sailing, Wise was… choppy. My situation was messy from the start because I had an old work account I couldn’t access. This led to multiple verification loops, SMS codes that never arrived, WhatsApp backups that did, ID selfies, old-email dead ends, and even a moment where Wise told me I couldn’t log in but then magically let me in, only to block me again when I tried to add a card.

There was one fun surprise: I discovered $399 USD sitting in that old account while on a support call with their rep (!), but the joy was short-lived. I hit error after error trying to add the virtual card to Apple Wallet after he updated my email, even after verifying my ID and adding funds.

Real-world swipe: I wanted to test one of these cards with an online purchase instead of in-store, and Wise made sense for that, especially since, for reasons still unknown, the app wouldn’t let me add the card to my Apple Wallet. Since I couldn't test the Wise virtual credit card in a store, I decided to make a purchase on Amazon with it instead. After entering the card number and all my details manually, the purchase went through: a $23 mini portable fan to help beat the Toronto heat wave.

Standout facts:

- Card type available: Prepaid only

- Annual fee: $0

- Rewards: None

Virtual Credit Card Cheat Sheet

Final thoughts

Testing these four cards back-to-back was like speed-dating the Canadian fintech scene. Some were smooth and quick; others tested my patience. If I were signing up again tomorrow, I’d start with Neo Financial, Wealthsimple, or Koho, all easy to set up, simple to fund, and reliable from the first swipe. EQ Bank is fine if you’re willing to wait for the physical card, and Wise shines for travellers, but requires more patience than most people will want to give.

And if you’re here for a true virtual credit card (one that will allow you to spend money you don't have), your options are even narrower: Neo Financial and Wealthsimple are the only ones on this list offering actual credit products; the rest are prepaid or debit-style cards.