With most of the Big 5 Banks offering little to no interest on savings accounts, more and more Canadians have been turning to online savings accounts from digital banks and fintechs.

These accounts typically pay more interest than traditional banks, have unlimited transactions, and don’t charge monthly fees.

If you haven’t already opened a savings account from an online bank, there’s a good chance you’ve thought about it. If you’ve yet to take the plunge, what’s holding you back? Are you unsure of the account opening process, what documents you’ll require, or how to deposit money into a bank account without any physical branch locations? And how will you access your money?

To answer these questions and hopefully put your mind at ease, I spent an afternoon opening savings accounts at 5 of the most popular online banks in Canada, and I’m sharing my experience here. Before we dive in, I should point out that I followed a few simple rules to keep things fair and ensure a level playing field:

- I opened all of the accounts on my laptop from the bank websites, not the mobile apps, although you can do that, too.

- I timed how long it took to open each account and transfer in $10 from my main account (at a different bank).

- I disregarded any available promotional offers.

- In all cases, I was a brand-new customer and did not hold existing accounts with any of these banks.

Here are the results!

Neo Savings

- Savings Interest Rate (APY): 2.25% to 2.90%

- Time to open and fund the account: 25 minutes

Neo Financial was launched in 2019 by the team behind the massive delivery app SkipTheDishes. Neo Financial is not an actual bank, but a financial technology company that offers banking services, including the Neo Savings Account, which offers up to 2.90% in interest.

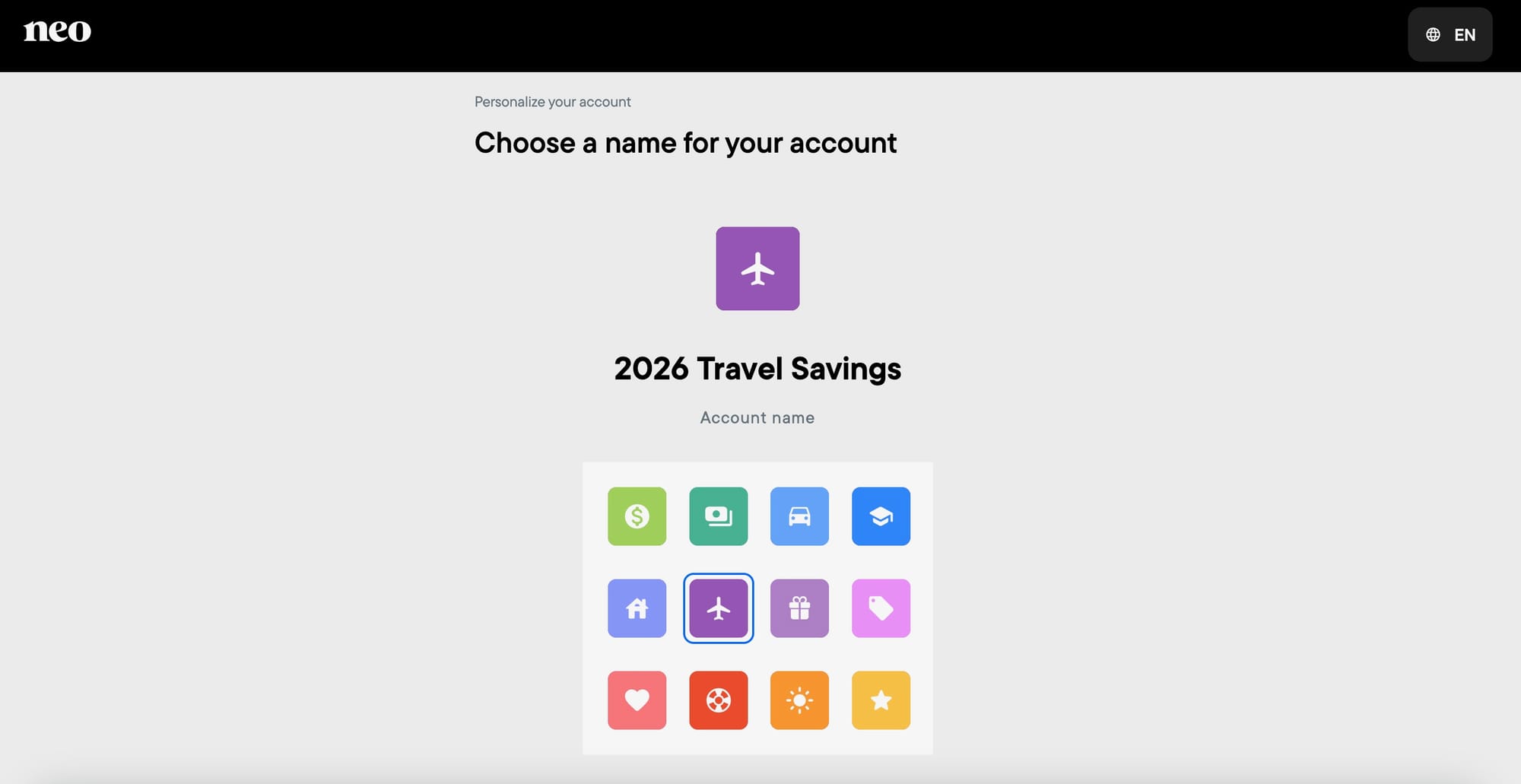

The process of opening my Neo Savings account was almost identical to opening an EQ Bank account, with one twist. After providing Neo with my email and phone number and receiving my verification code, I was given the option to personalize my account by assigning it a name and an icon. Very cool! I decided to name it Travel Savings 2026. (Here’s hoping!)

My Neo account was opened within a few minutes. However, when I attempted to link my external bank account, it sat in a pending status for about 10 minutes before I was able to transfer in the $10. I’m not sure why that happened, so I’ll chalk it up to a slow wifi connection. Once the “pending” disappeared, the money showed up in the account within a couple of minutes.

Another smooth experience!

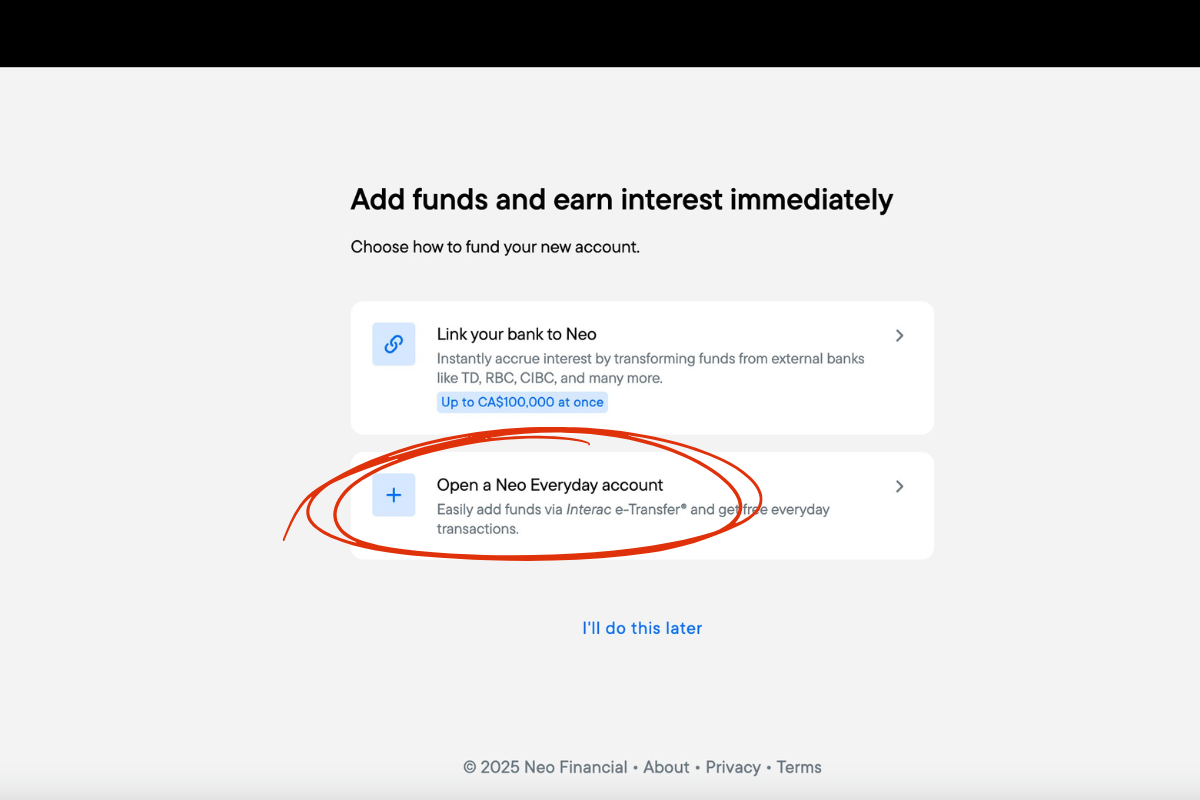

I should point out that I had the option to send the $10 to Neo via Interac e-Transfer; however, Neo states that to do so, you must also open a New Everyday account. I wasn’t prepared to do that. You can see that in the screenshot below:

EQ Bank Savings

- Savings Interest Rate (APY): Up to 2.75%

- Time to open and fund the account: 15 minutes

EQ Bank is a purely digital bank, which means there are no branches you can visit. It’s been around since 2016 and has become well-known for offering high interest rates and savings accounts with no monthly fees.

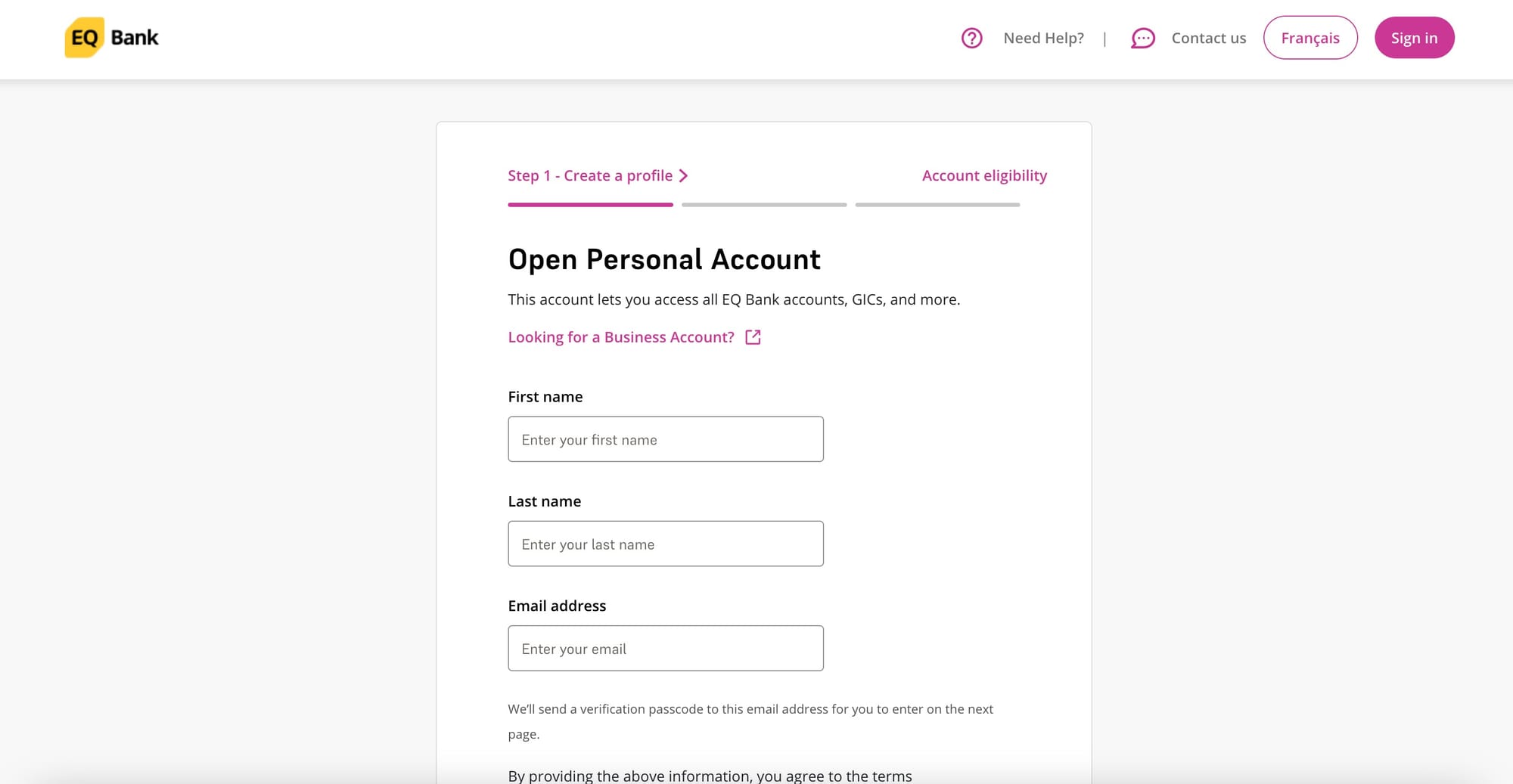

To get started with EQ, I had to provide my email address and phone number and receive a verification code. From there, they asked me to choose an account type, which was a personal savings account.

Within a few minutes, my account was open. Much to my surprise, I didn’t need to upload any ID or other documentation to complete the account opening process.

From there, I began the process of linking my external bank account to deposit the $10. EQ uses a third-party provider to transfer funds securely between institutions. To complete the account sync, I had to select my other bank and log in using my existing online banking password.

When I submitted the transfer request, EQ informed me that the funds would be available within four business days. However, the $10 appeared in my new EQ savings account within three minutes!

The total time from when I arrived on the EQ website was 15 minutes… I was impressed!

On to the next bank…

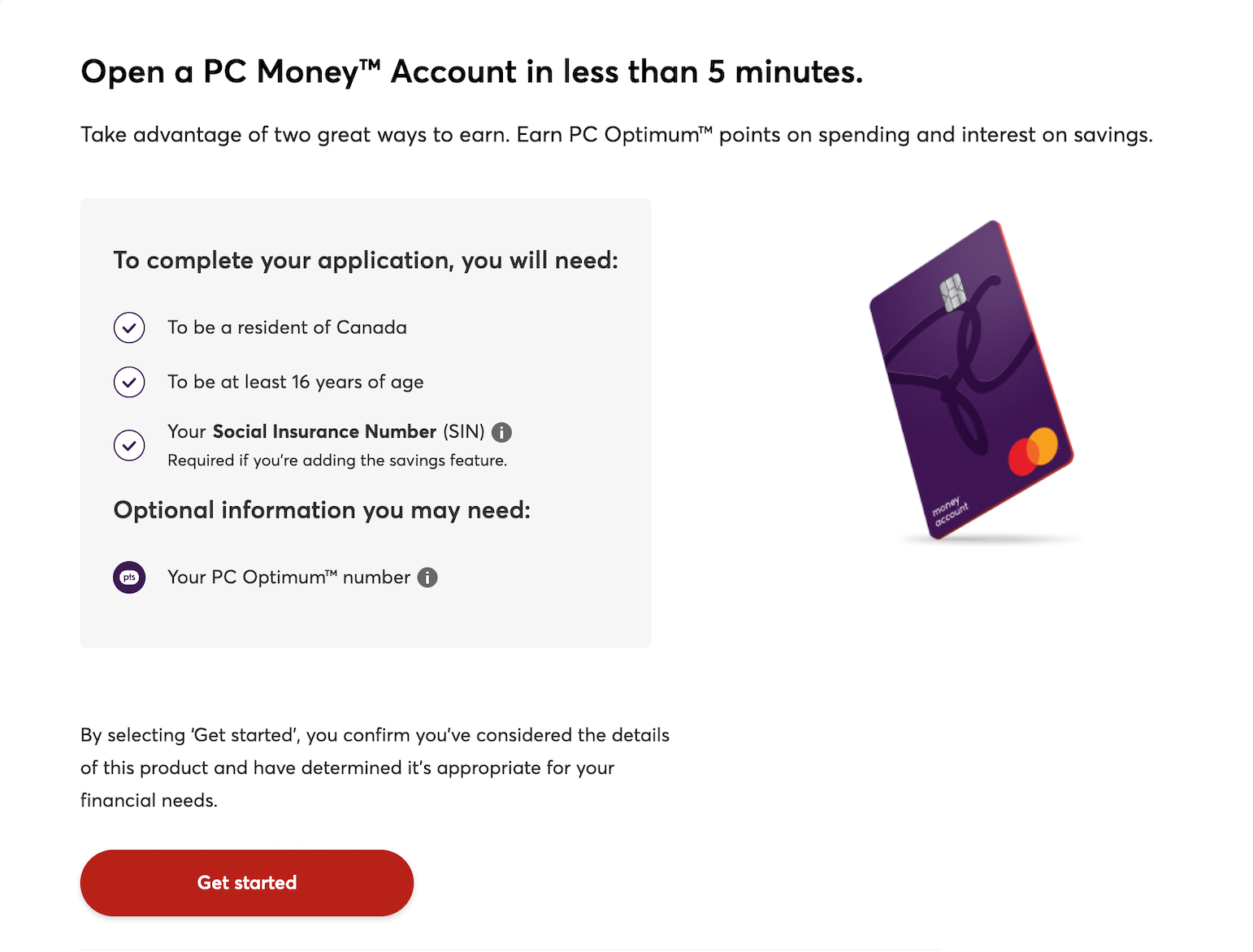

PC Money Account

- Savings Interest Rate (APY): 2.2%

- Time to open and fund the account: 12 minutes

The third account I opened was the PC Money Account, from President's Choice Financial. It’s basically a hybrid savings/chequing account that currently pays a generous 2.2% interest. You also get unlimited transactions with no monthly fees.

As with EQ and Neo, account opening and funding went very quickly, taking just over 10 minutes. This didn’t surprise me, since PC Financial has been doing online banking for a while, so I would expect them to have the process down pat.

WealthONE HISA

- Savings Interest Rate (APY): 2.60%

- Time to open and fund the account: 24 hours

Ever heard of WealthONE Bank of Canada? Neither had I, but they are an online-only bank that launched in 2016 to serve Chinese Canadians. While they still cater to the Chinese community, they have since expanded their operations and now offer financial products and services to all Canadians. This includes a high-interest savings account with a competitive interest rate, unlimited transactions, and no monthly fees.

When I started opening my WealthONE High Interest Savings Account, I was impressed that I could enter my address manually. This might not sound like much, but I have separate street and mailing addresses, and had a harder time getting EQ and Neo’s automated systems to accept them properly.

The account opening seemed to move along very quickly with WealthONE (about 5 minutes), until it didn’t.

After submitting my application, I couldn’t log in to my account because it was asking for a branch and client number, which I wasn’t provided with.

I tried calling WealthONE’s customer service, but they had just closed for the day. This was a Thursday. I called again on Friday and left a voicemail. A little later, they called back (and emailed me) to let me know my application had been approved. They also gave me the login details I needed to access my account.

I was able to log in to the account and transfer $10 from my main bank account. Overall, a slower process than EQ, Neo, and PC, but everything was completed within 24 hours, so I couldn’t complain. They do say that it can take up to 7 business days.

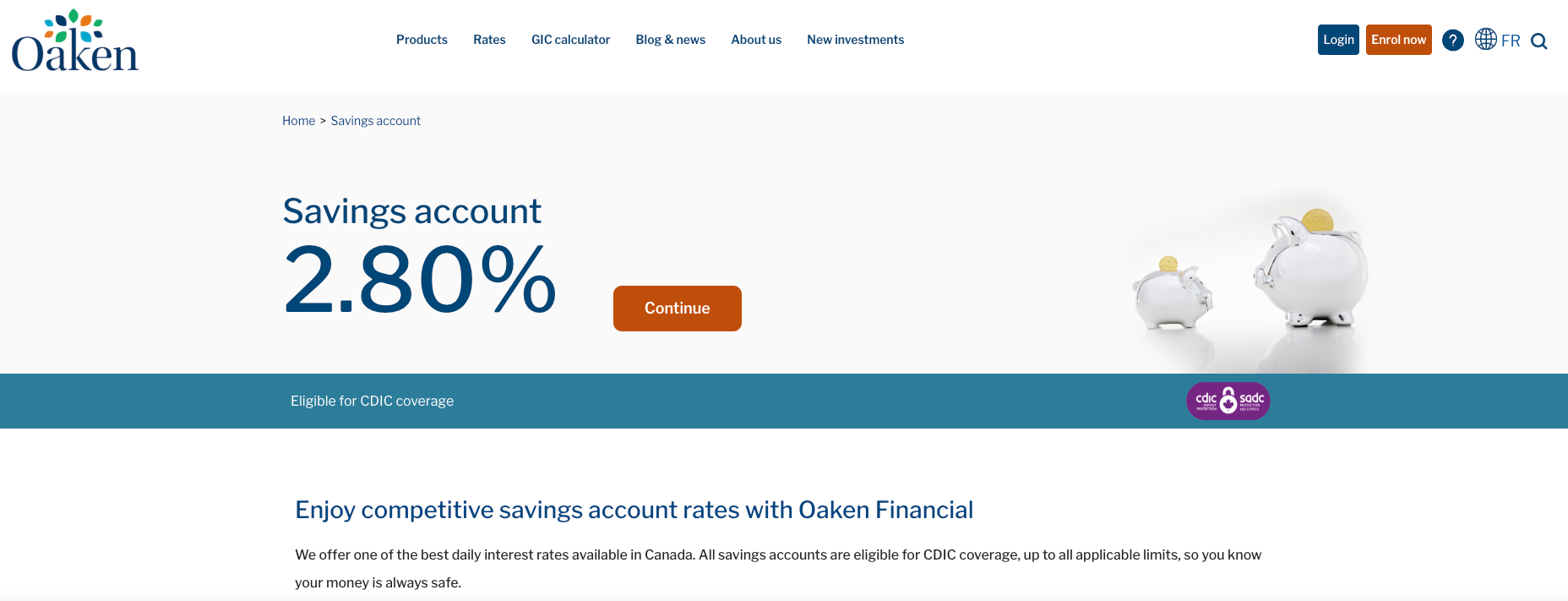

Oaken Financial Savings

- Savings Interest Rate (APY): 2.80%

- Time to open and fund the account: TBD

Oaken Financial is a digital banking platform and subsidiary of Home Trust. It offers a range of deposit products, including a no-fee high-interest savings account.

Where do I start with Oaken? Its account-opening process was very different from all the others I opened. It was also the most annoying, in fact, as I write this, days later, my Oaken savings account is still not activated.

I was able to create a profile on Oaken’s website in 1-2 minutes. I then had to log out and log back in to open a savings account. I’m not sure if this was a glitch, but it was a bit strange.

It was the only bank that required me to sign digitally in the application. It accepted my address, but the system wouldn't format it correctly. I hope they don’t have to mail me anything.

Once I completed the account-opening process, a message appeared stating that my application had been submitted and would be reviewed. It didn’t display an estimated timeframe on the screen, and the new account didn’t appear in my profile immediately.

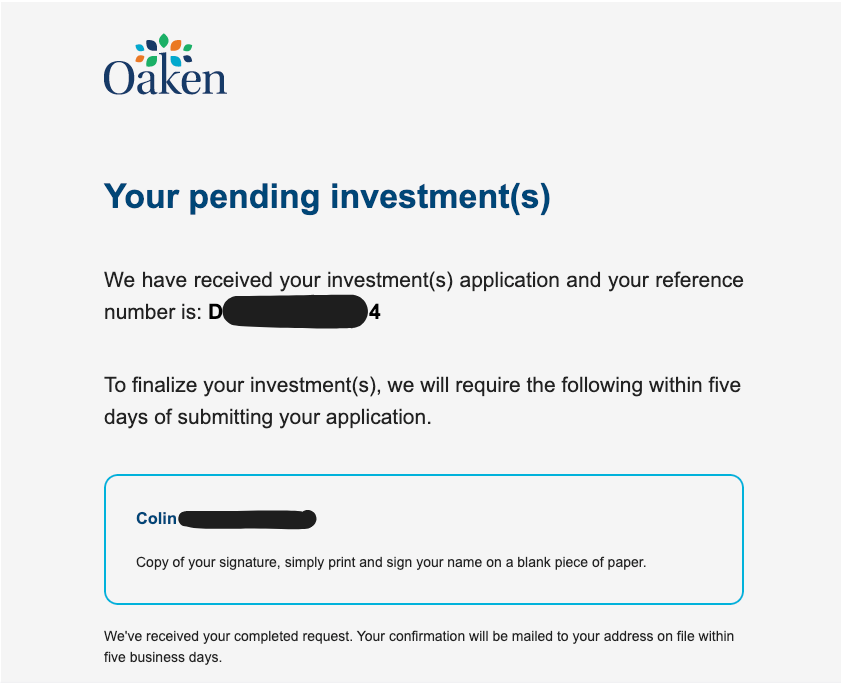

Shortly after, I received an email that said I needed to sign my name on a piece of paper, but it didn’t tell me what to do with it. I had already signed a virtual signature using my laptop's trackpad.

I called Oaken’s customer care department and was told that their back office was reviewing the account and that it would take 7 to 10 business days!! I was told that the account would be opened at the earliest in the week of November 10th. (They sent me the email on Friday, October 31.)

I then received another email requesting that I send them a copy of a valid ID (driver's license or passport), as well as a void cheque and a bank statement from my primary bank, to link my account once it was opened. Furthermore, it had to be an official bank statement from the past 30 days and could not be redacted.

Long story short, I sent Oaken my documents and am still waiting for the account to be opened and my $10 to be transferred in. Once that’s happened, I’ll add an update to this article!

Clearly, Oaken has a much more manual, antiquated account-opening process, especially for an online bank.

Summary

There you have it, my experience opening five popular online savings accounts in Canada. If you ask me, the results speak for themselves. The easiest accounts to open were from arguably the most recognizable brands: EQ, Neo, and PC Financial. I was able to open (and fund) accounts with all three in under 30 minutes. And while the Neo account sat in a pending status for about 10 extra minutes, the process was just as simple as with the other two.

WealthONE’s results were respectable, as they were able to review and open my account within one business day, and funding only took a few minutes. Oaken Financial, on the other hand, did not measure up. While I respect their diligence in requesting a copy of my ID, their process is far too manual and resembles that of a credit union or a traditional bank. At least their interest rates are competitive!

Speaking of interest rates, remember that all these online banks offer higher savings account rates than the Big 5 Banks. Your bank might try to woo you with an attractive promotional rate, but those always expire after a few months.

*Interest rates are subject to change.