Canadian credit-score apps are aplenty, and it’s a fantastic way for people to keep track of their financial health. I downloaded four popular ones: Borrowell, Credit Karma, ClearScore and KOHO to see which one I like most.

For my test, I pulled my credit score in each app, took screenshots, and tracked how quickly the apps loaded, how often they refreshed, and what kinds of offers they bombarded me with.

Did you know that half of secured Neo card holders improve their credit score by an average of 26 points in just 3 months? Plus, sign up now via the button below and get a $60 welcome bonus.

* Limited-time offer. Only valid for new Neo customers who open their first eligible Neo credit product and make a purchase within 90 days. Limit of one offer per customer. Offer is subject to the Neo Rewards Policy and may be amended or cancelled at any time without notice.

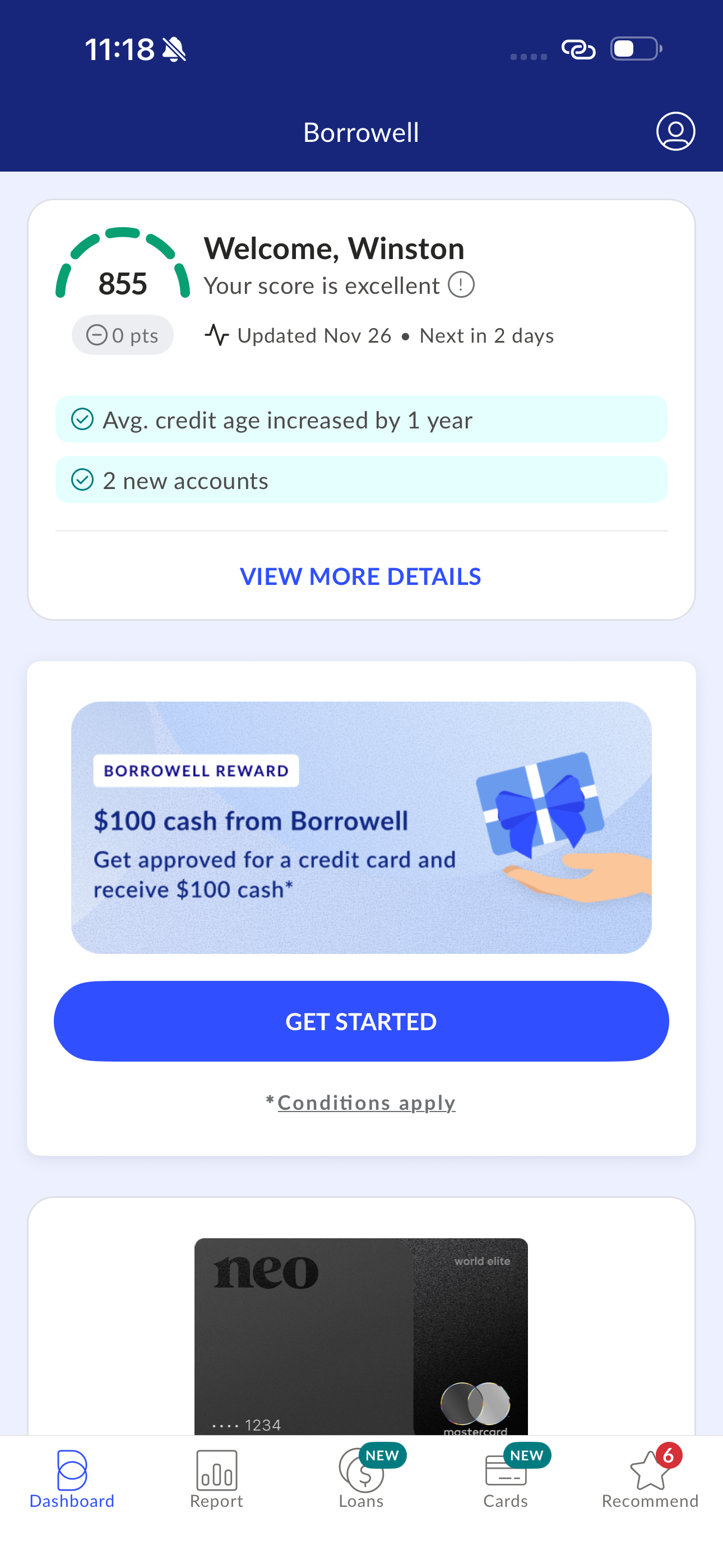

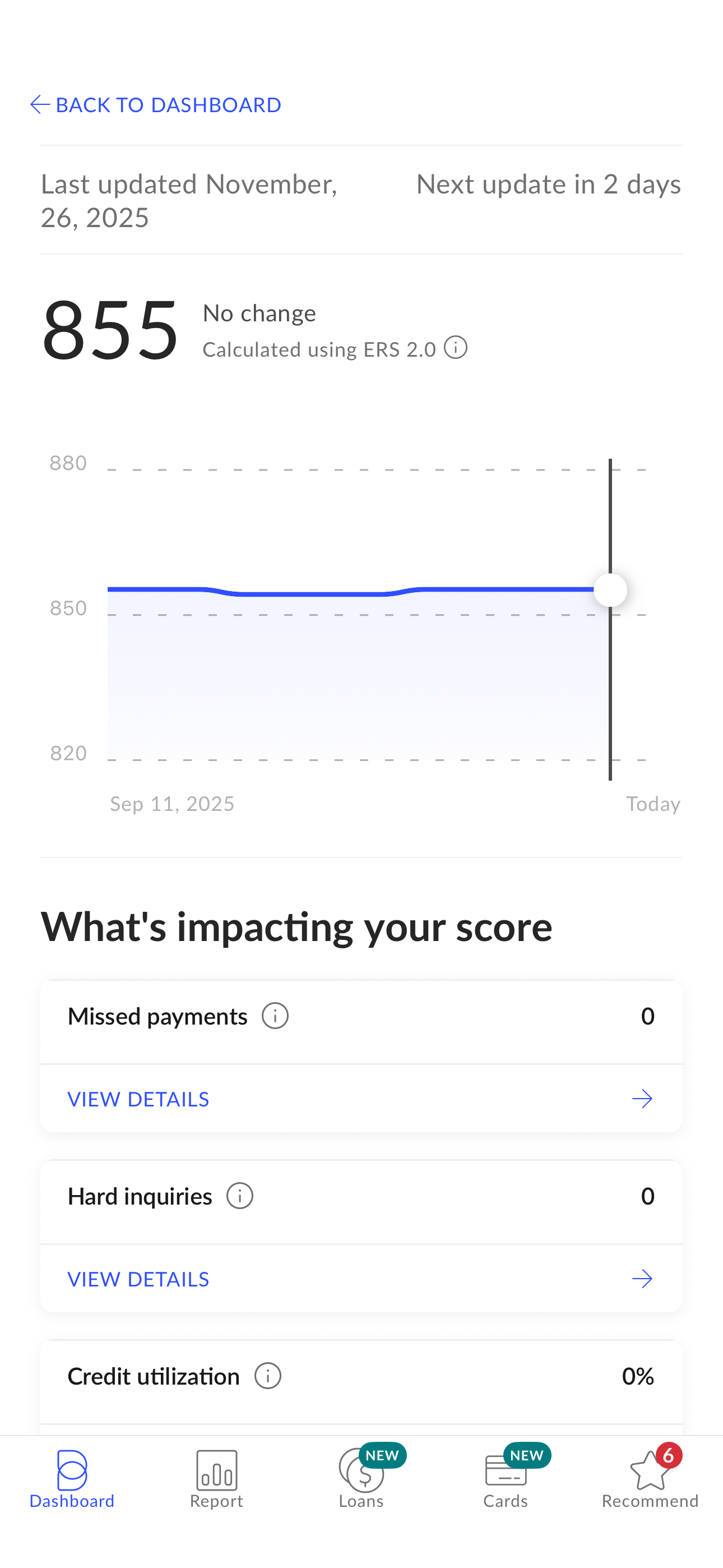

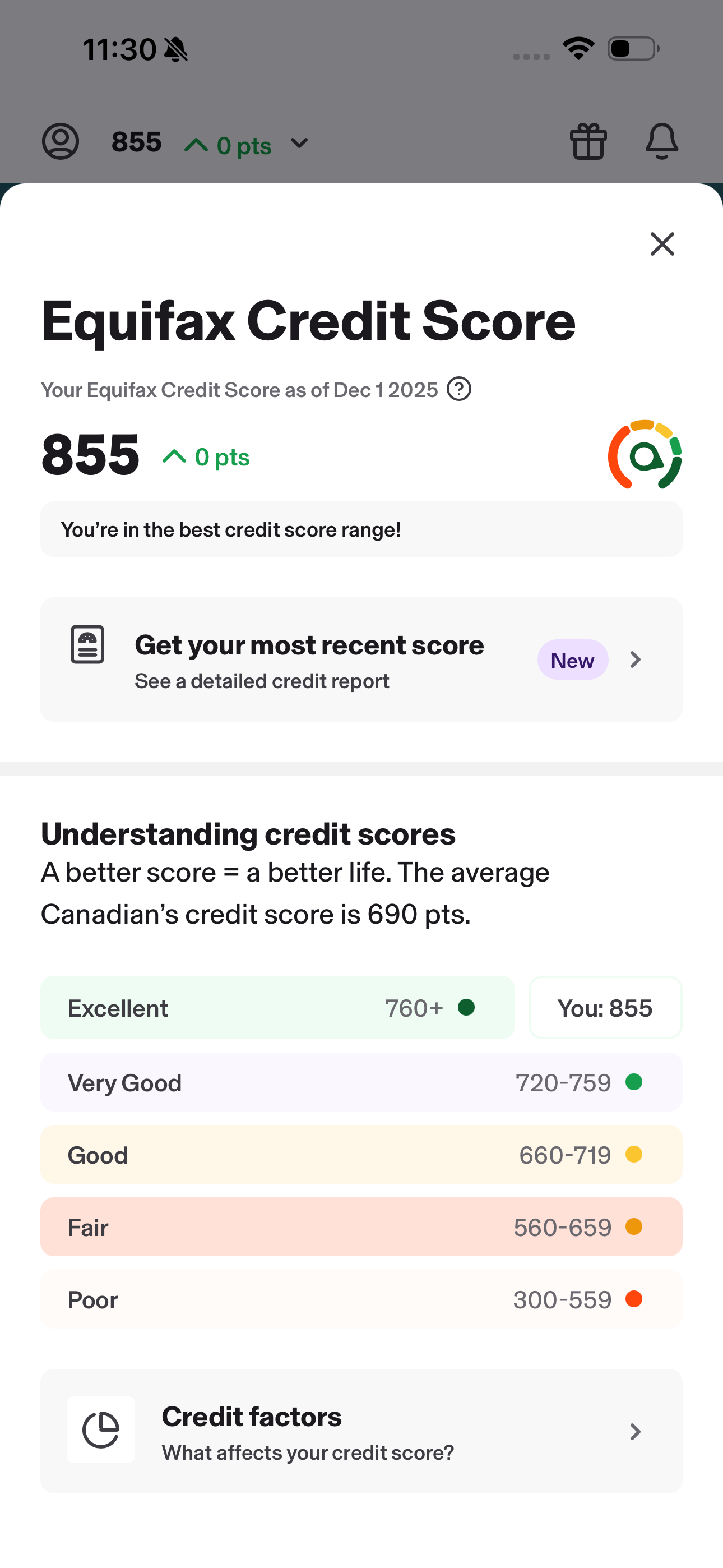

Borrowell App: My score was 855

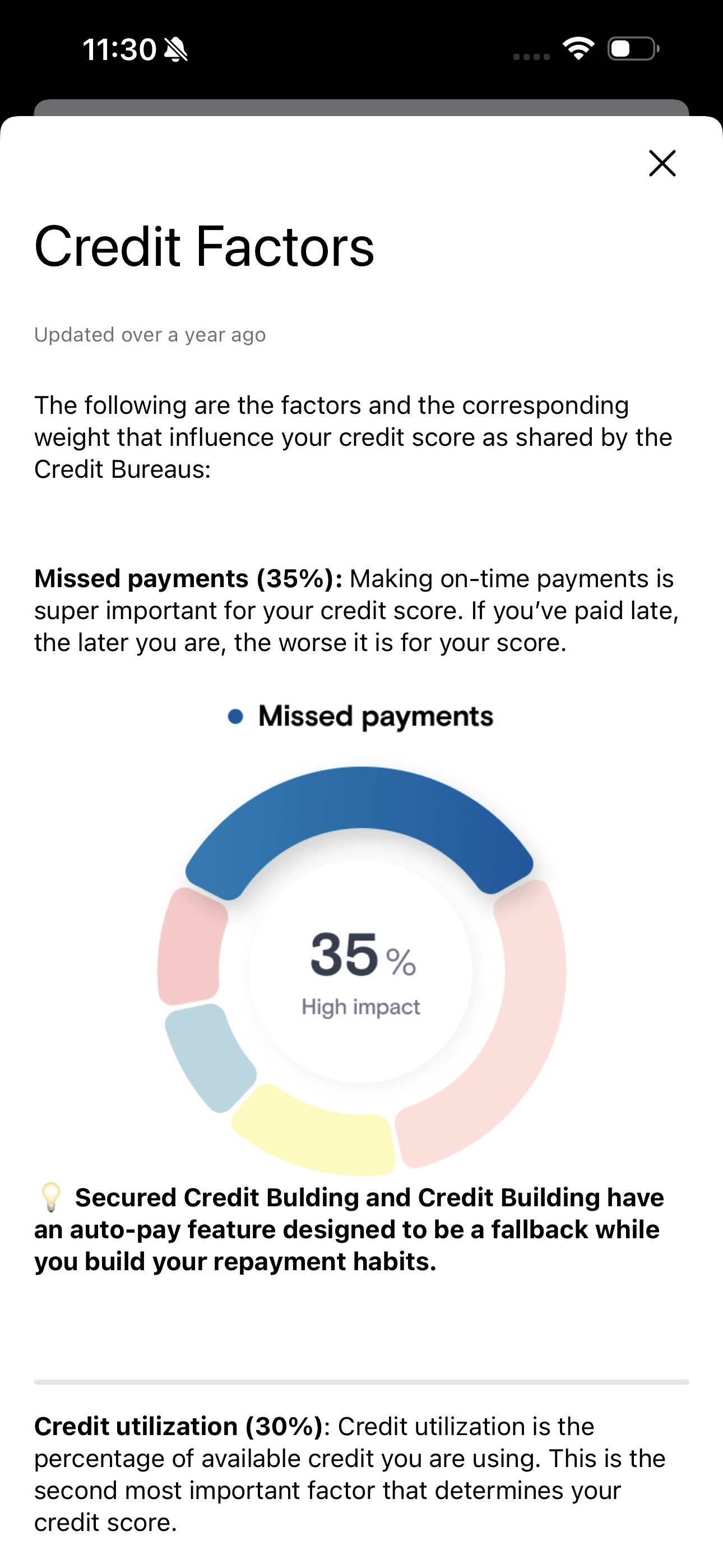

Borrowell gave me an 855. I got that number about 15 seconds after opening the app. Borrowell uses Equifax data to build its score.

The interface felt clean and easy to read. I could see a chart of my history, utilization and payment record without digging through menus. Borrowell refreshes weekly. That makes it great if you want to check progress without waiting monthly.

The app suggested some credit-card offers and loans tailored to my profile. The offers felt relevant. If you want to see what products you might qualify for, Borrowell gives you that without being too aggressive.

On day one, the app hit me with many notifications. I turned most off. Other than that, Borrowell felt dependable. For Equifax-based credit tracking, I liked it a lot.

Get a $60 welcome bonus by signing up for any secured Neo Mastercard using the button below.

* Limited-time offer. Only valid for new Neo customers who open their first eligible Neo credit product and make a purchase within 90 days. Limit of one offer per customer. Offer is subject to the Neo Rewards Policy and may be amended or cancelled at any time without notice.

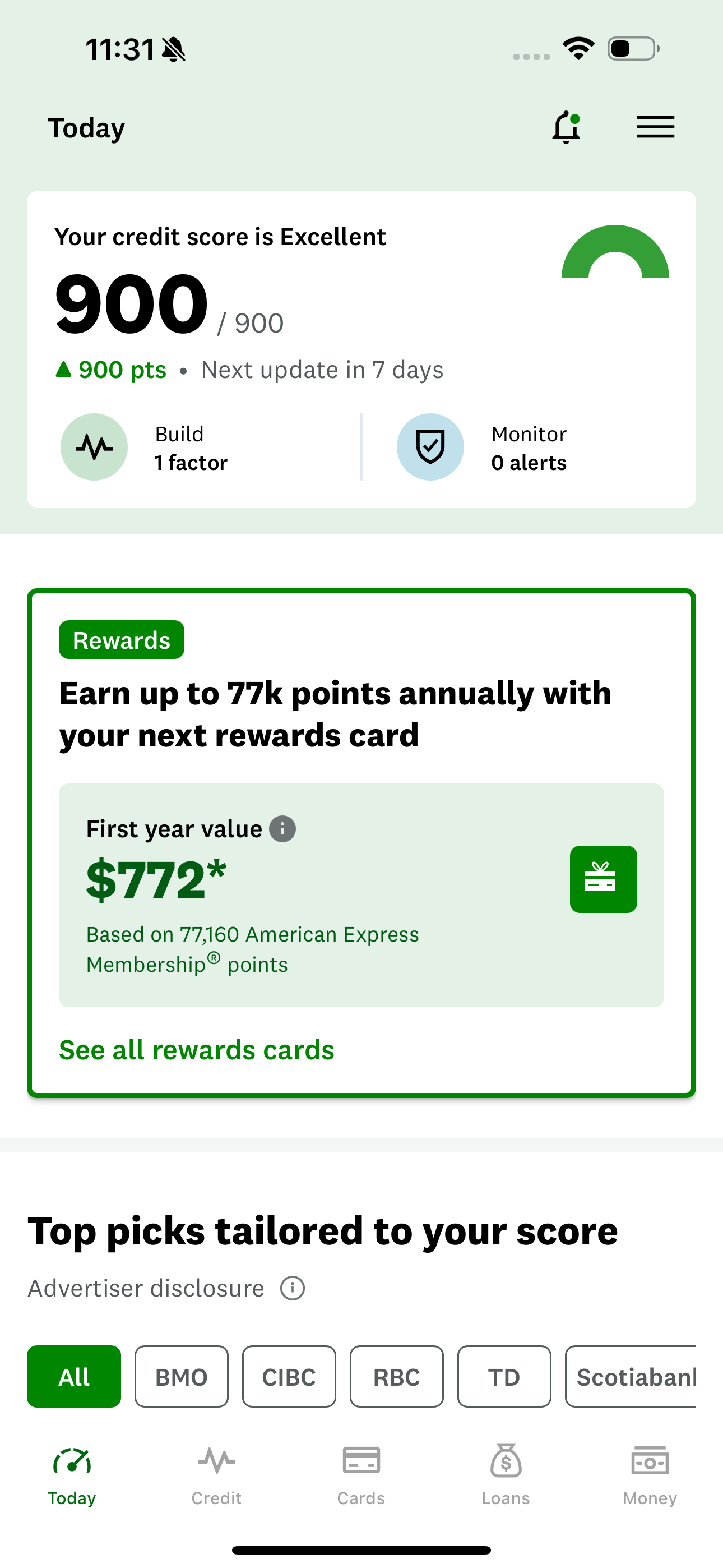

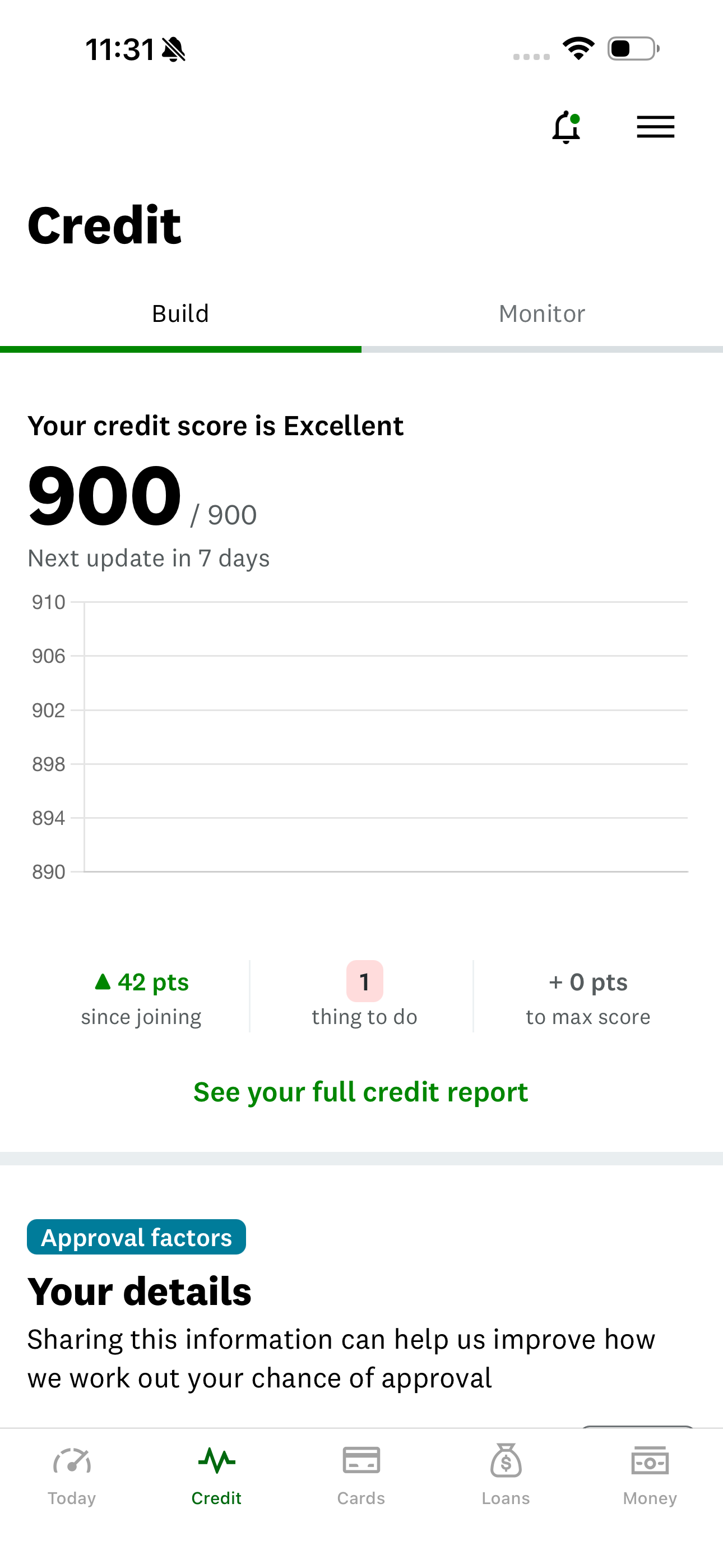

Credit Karma App: My score was 900

Credit Karma pulled a 900 for me. That score was based on TransUnion data, the other big bureau in Canada.

It loaded in under 20 seconds. I liked how Credit Karma showed a timeline of changes in my credit score. That helped me see what caused my score to jump or dip over time. That felt more real than just a static number.

Credit Karma also refreshed weekly when I logged in. The interface was friendly. The offers and product recommendations felt slightly more aggressive than Borrowell’s. They pushed a few loans and cards I had no interest in, but having a TransUnion-based view made it valuable.

For me, Credit Karma balanced Borrowell because it provided the TransUnion view of my credit score.

ClearScore App: My score was 900

ClearScore showed 900 using Equifax data. Setting it up was slower than the others. It made me answer more identity questions and required a bit of patience before the score loaded.

Once the score showed up, I liked that I could actually download my full credit report with one tap. That felt like real control and access to my personal financial data. ClearScore updates monthly, which is less frequent compared to Borrowell and Credit Karma.

The layout felt busier than I liked, and the app pushed many product offers right to the front. It made the whole thing feel crowded. I could see value in keeping ClearScore on my phone just for the full-report download. But I would not use it for regular checks.

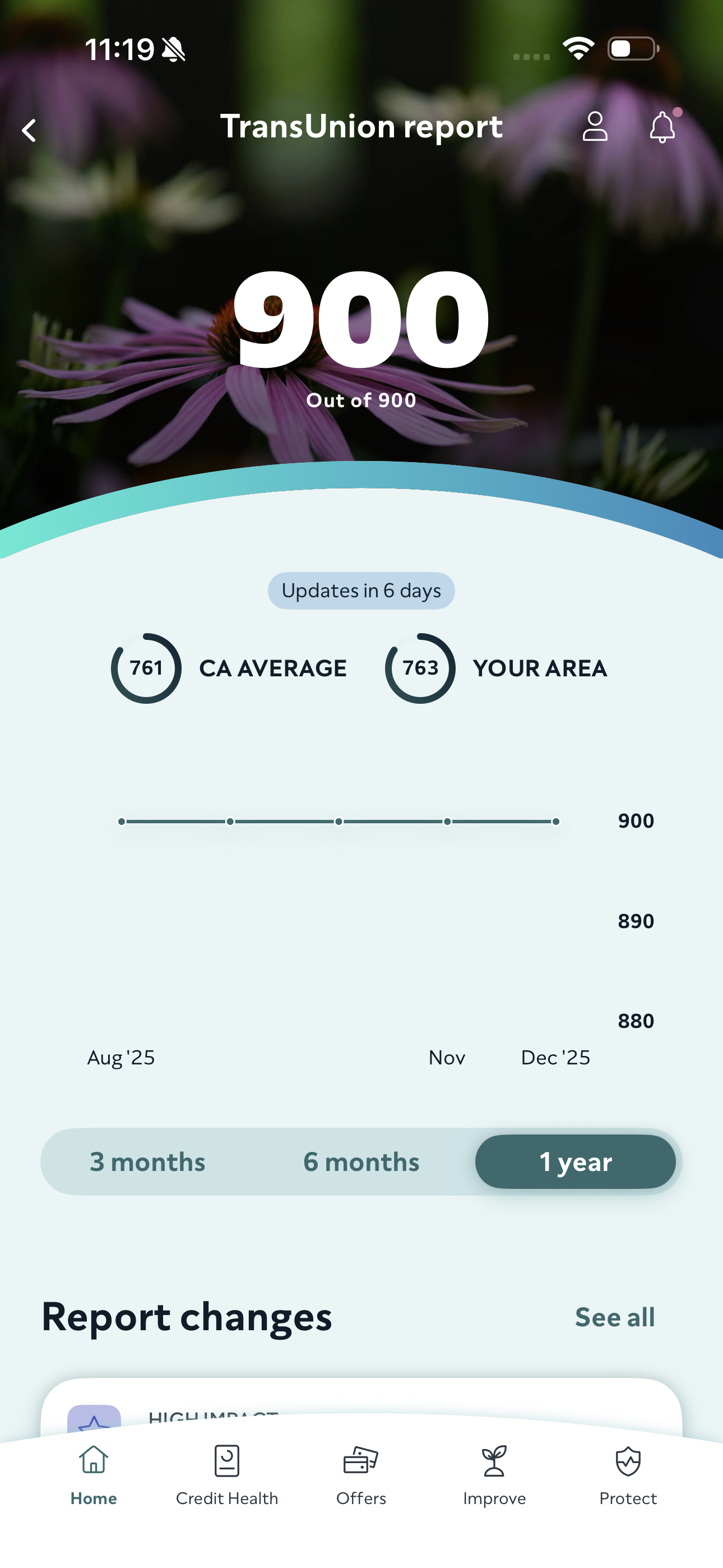

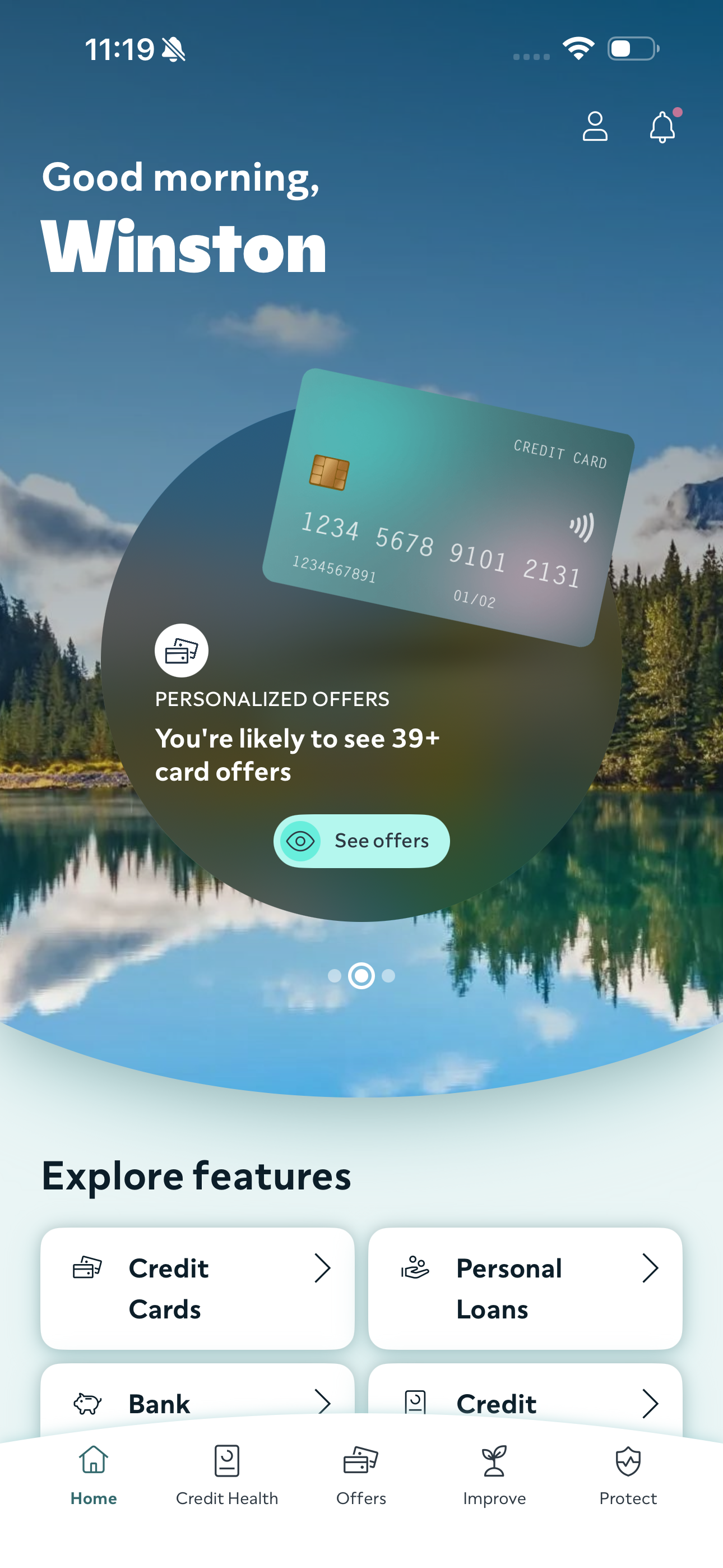

KOHO App: My score was 855

Finally, KOHO returned a 855 and used TransUnion data. This app is different because the credit-score feature lives behind a paid tier. That felt more like an add-on than a core function. KOHO has various paid tiers, but for my purposes and checking my credit score, I got the Essentials tier at $7 per month.

KOHO loaded my score in about 20 seconds, while the refresh rate is monthly. The design looked smooth, and the language was simple. But the credit section felt secondary. KOHO is clearly made as a spending and savings tool first.

If I were just tracking credit, I would not keep the KOHO app. I can see KOHO being helpful for those looking for a budgeting tool or prepaid-card convenience.

Lessons learned

While I've already compared these kinds of websites, I didn’t dive into the app experience itself.

In the end, I decided to keep two apps on my phone:

- Borrowell for Equifax-based tracking.

- Credit Karma for TransUnion-based tracking.

Those two together let me see both sides of Canada’s credit-score system. They load fast, update often, and feel useful.

ClearScore is great, but it is a better desktop experience. As it is a monthly refresh, this is great for auditing details in your full credit report. I also ditched KOHO as a credit-score tool.

Putting this all to use helped me understand what’s really going on with my credit. I saw how different bureaus report different pieces of data. I noticed how refresh rates and scoring models affect the numbers.

I went into the experiment expecting little, but I came out with apps that help me actually follow credit over time. That’s the financial pulse check that every Canadian should do on a regular basis.