SPONSORED. I’m not in the market for a loan right now, but as we all know, life can change pretty quickly. Whether it’s a major, unexpected car repair or your furnace decides to stop working in the middle of January, the time might come when you need cash and fast.

If something like that happened to me and I didn’t have the cash on hand to cover the expense, a personal loan would be one option to consider. Depending on how much you borrow, you can usually pay back loans over a few years with manageable payments. And they often have lower interest rates than credit cards, making them a more sensible choice.

I was recently tasked with reviewing Smarter.loans, a Canadian loan comparison website, and it got me thinking. If I really needed a loan like that, could Smarter.loans actually help, or would it be a waste of time?

So I decided to check it out for myself to see what the experience was like.

Before I get into what I found, here is something important to understand. Smarter.loans is not a lender. They do not actually loan you money. They are a loan comparison website. Think of it like an online shopping mall for loans. You plug in the type of loan you need and the amount you want to borrow, and they provide you with a list of lenders, interest rates, loan amounts, and terms, along with a link to each lender’s website where you can apply.

They also do business and auto loans, which could help people in different situations. But for this review, I wanted to focus on personal loans, because that is what most people are searching for when they hit the site.

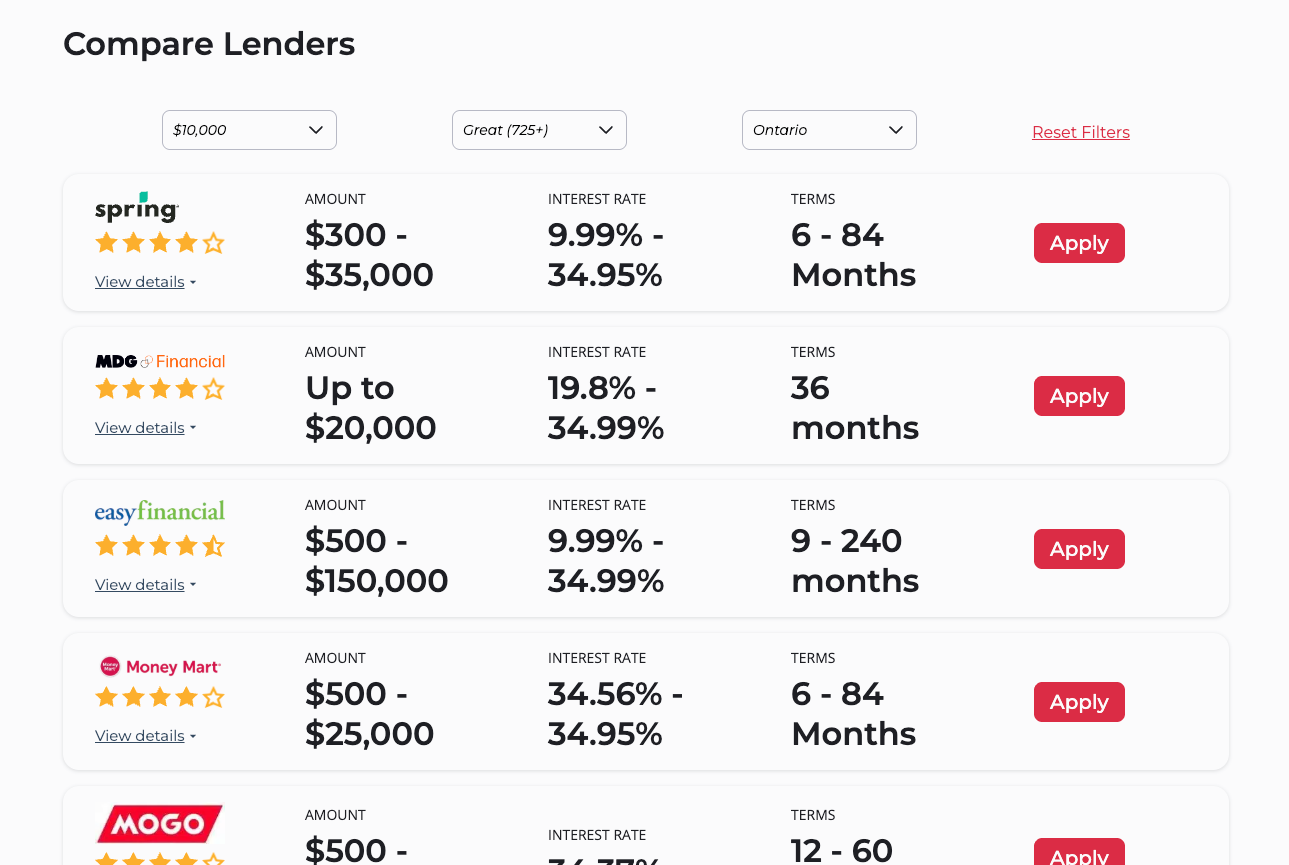

So, I pretended I needed a $10,000 personal loan and started searching.

I selected that I had a great credit score (725+), but something funny happened. I noticed that the same lenders and interest rate ranges appeared regardless of the credit score I chose.

I could also tell that most of the lenders on the site are what we would call subprime lenders. That means they are more likely to approve people with bad credit or a limited credit history. But that also means that the interest rates are usually much higher than you would get at a bank or credit union.

I counted around sixteen different personal loan lenders listed on the site. When I filtered for a $10,000 loan, some lenders disappeared because they only offered smaller loans. But several options were still there.

My $10,000 personal loan search results

For example, Spring Financial showed loan amounts ranging from $300 to $35,000. Their interest rates ranged from about 10% to nearly 35%, with repayment terms of six months to seven years.

MDG Financial offers loans up to $20,000 (they didn’t list a minimum amount), and their rates are roughly between 19% and 35% with a three-year repayment term.

EasyFinancial offered between $500 and $150,000, with interest rates from about 10% up to nearly 35% percent. Their repayment terms can range from less than a year to 20 years in some situations.

I was surprised to see Money Mart on the list, but there they were. They offered loans ranging from $500 to $25,000. Their interest rates were right near the top of the range, around 34%, with repayment terms between six months and seven years.

Other lenders, including Mogo, CashMoney, and LendDirect, also came up in the search results.

What happened when I hit “Apply”

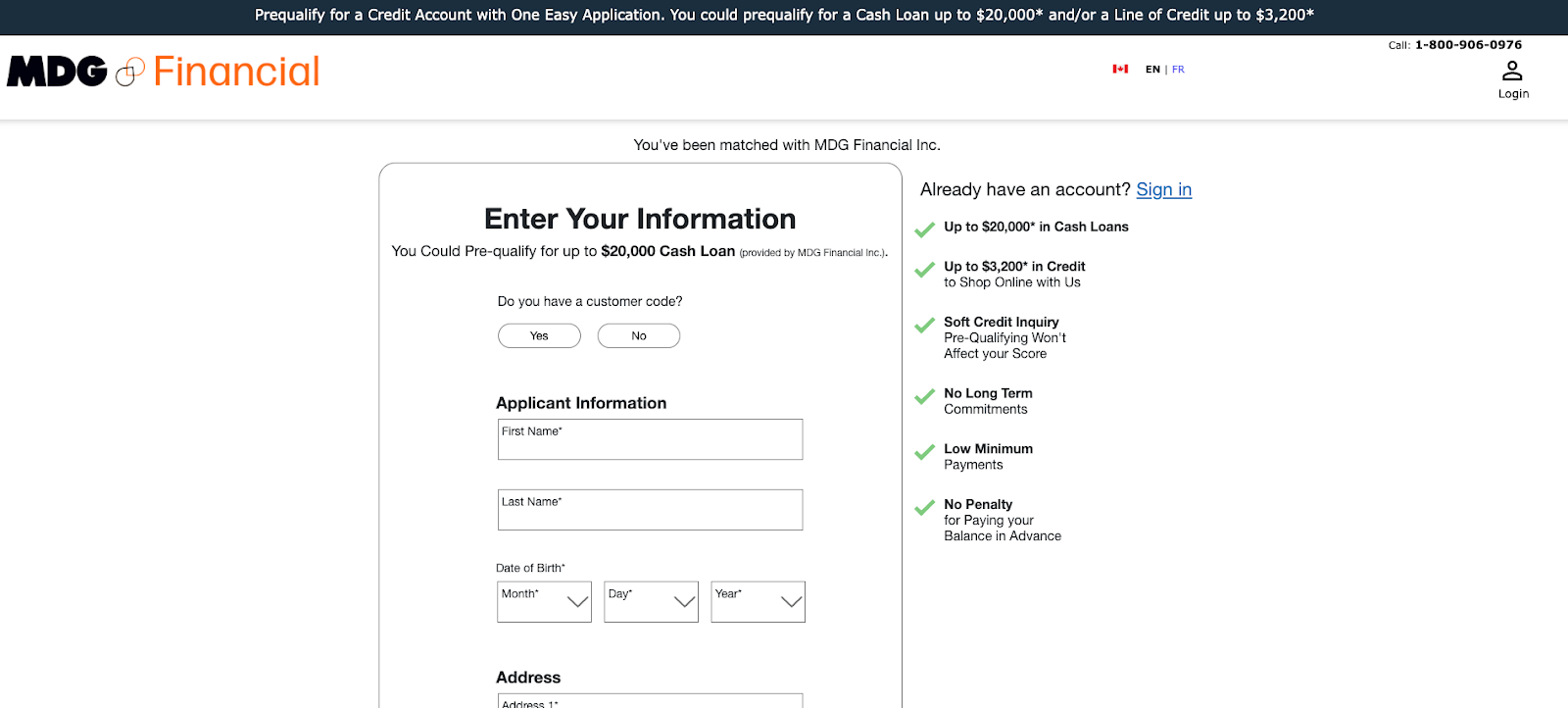

When you click Apply on Smarter.loans, you are taken straight to the lender’s website to start the real application. You don’t finish anything on Smarter.loans itself.

I wanted to go deeper than just reading numbers, so I clicked through the top five lenders in the search results to see what actually happens. Most of them let you know you’re just pre-qualifying with a soft credit check, which won’t hurt your credit score. Here’s what MDG’s application page looks like:

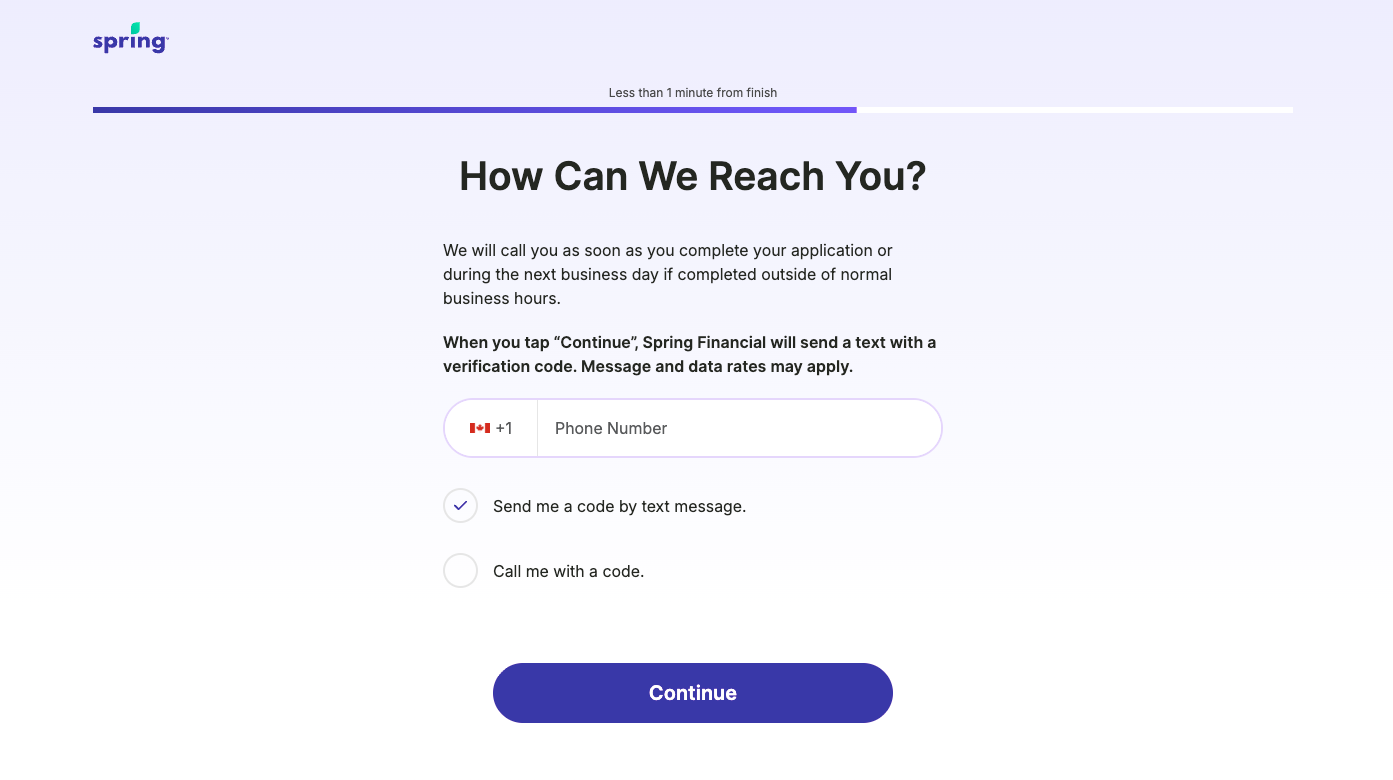

Since it wouldn’t hurt my credit, I decided to complete a soft application with Spring Financial. The process took around three minutes. They asked for my name, email address, home address, employment details, income, and phone number.

At the end, I had to agree to let someone call me within one business day to continue the process. They called me the next day.

I told the loan officer I wasn't actually going to take a loan right now, but I wanted to know what interest rate I'd likely qualify for based on the information I provided. They told me that they could not give me that information.

They said they could only give me the general interest rate range (the ones published on Smarter.loans) unless I completed a full application with a hard credit check.

I wasn’t ready to do that, so I politely declined. I also contacted EasyFinancial and MDG Financial to confirm, and they said the same thing. No interest rates until we do a complete application and credit check.

For me, this is one of the biggest drawbacks to this whole process.

The interest rate ranges are massive. For example, between 10% and 35% percent is a giant difference. 10% is reasonable. 35% percent is very expensive. But you will not know where you land until you apply and take a hard hit to your credit. And nobody wants to do that with five or six different lenders.

So, who is Smarter.loans really for?

From what I saw, it is probably not for someone with great credit who can easily qualify for a bank loan or credit union loan. Instead, Smarter.loans is best for people with bad credit, limited credit history, or if you have already been declined elsewhere. It might also help someone who needs money fast for an emergency, like car repairs, rent, or home repairs.

If that sounds like you, Smarter.loans could be a good option. But here’s the other big question. Can Smarter.loans save you time?

The answer is a resounding “yes”! If I went to Google, I would have had to search lenders one by one, open websites, scroll, read details, and try to compare everything myself. Smarter.loans lets you see loan amounts, interest rate ranges, repayment terms, and application links all in one place. It’s a huge time saver.