I’ve written about almost every money hack under the sun, and warned about the dangers of using credit to make ends meet. Paying rent with a credit card sits in this weird, grey area for me. And I have mixed feelings about it. Feels unhinged to just leave all those credit card rewards on the table. And the 21-day interest-free grace period is a clever way to be late on rent without being late on rent.

But at the same time, putting your housing payment on a credit card sounds like a financial clusterfuck in the making. I wanted to test the process myself. So I used the Chexy platform to pay for my December rent with my PC Financial Mastercard. Turns out, I was woefully ill-prepared and didn’t get any rewards at all. Here’s what happened so you can learn from my mistakes.

Finding Chexy & Signing Up

I Googled “how to pay rent with my credit card in Canada.” Chexy dominated the search results. I didn’t even know there were other options until after the experiment. For what it’s worth, there is another platform you can use called TenantPay. But Chexy seems to be the most popular, so that’s what I went with.

Signing up for Chexy was pretty fast and painless. I was done in less than five minutes. The only thing that slowed me down was digging up my lease. I signed it eight years ago, and it auto-renews every year. So I didn’t exactly have it handy. I knew it was filed somewhere in the back of a deep, dark drawer. Once I found it, I snapped a pic of the first page that listed the key details and uploaded it to the Chexy website.

Chexy asked for my name, phone number, occupation, date of birth, and rental address. They verified my identity based solely on the information I entered. They did not ask for photo ID. After that, I clicked ‘New Payment,’ then chose ‘Rent,’ and followed the prompts.

Choosing How My Landlord Gets Paid (And the Moment Everything Fell Apart)

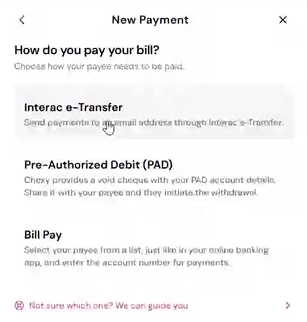

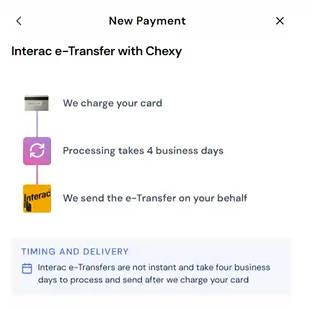

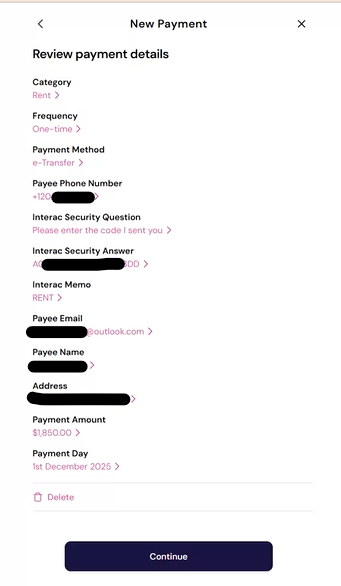

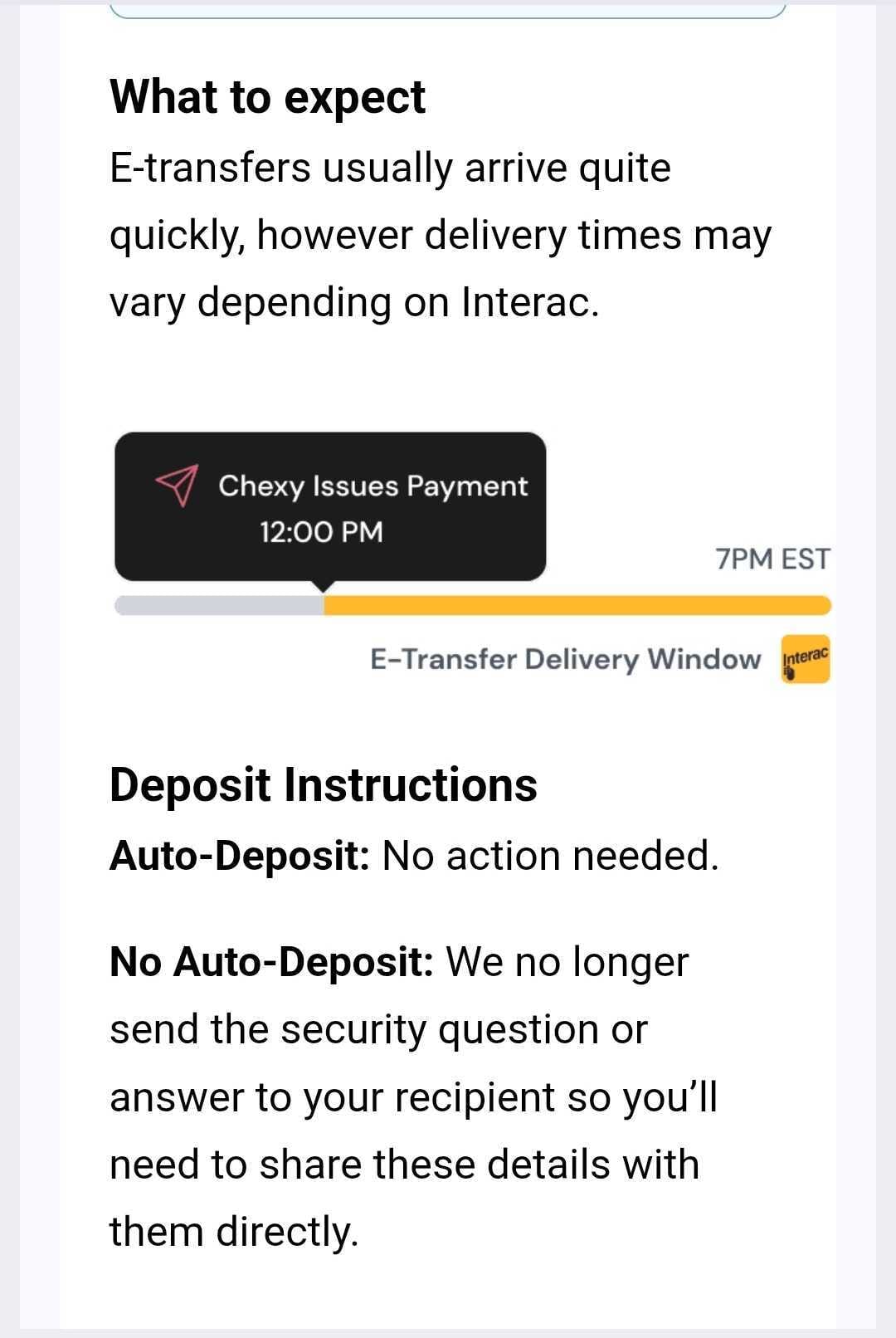

I had three options for how my landlord would receive the money. I could choose Interac eTransfer, direct deposit, or bill pay. I already pay my landlord by eTransfer, so that’s what I went with. Chexy warns you that eTransfer payments can take four business days to process. My rent is due on the first of each month, so I started the process on November 25th to give myself wiggle room.

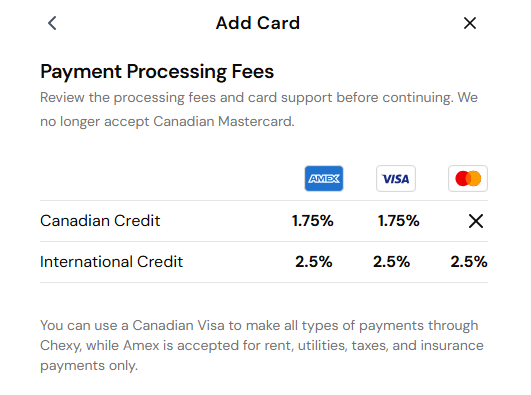

Then it was time to add my payment method, which is where things fell apart. I went into this excited to use my PC Mastercard and earn a pile of PC Points on my rent. When I hit the payment screen, I found out Chexy does not accept Canadian-issued Mastercards. Only Visa and Amex. All three of my credit cards are Canadian Mastercards. I had painted myself into a corner without realizing it. Stupid, Heidi. You should have checked this before signing up!

Since I had no compatible credit cards to use, I paid with my Tangerine Visa Debit. But the silver lining was that debit payments are free. Well, at least there’s that! Chexy charges a 1.75% transaction fee to pay with Visa or Amex, but debit cards cost nothing. If I had used a foreign credit card (not issued in Canada), the fee jumps to 2.5%.

Protip: I found out later that Chexy’s competitor, TenantPay, does accept Mastercard.

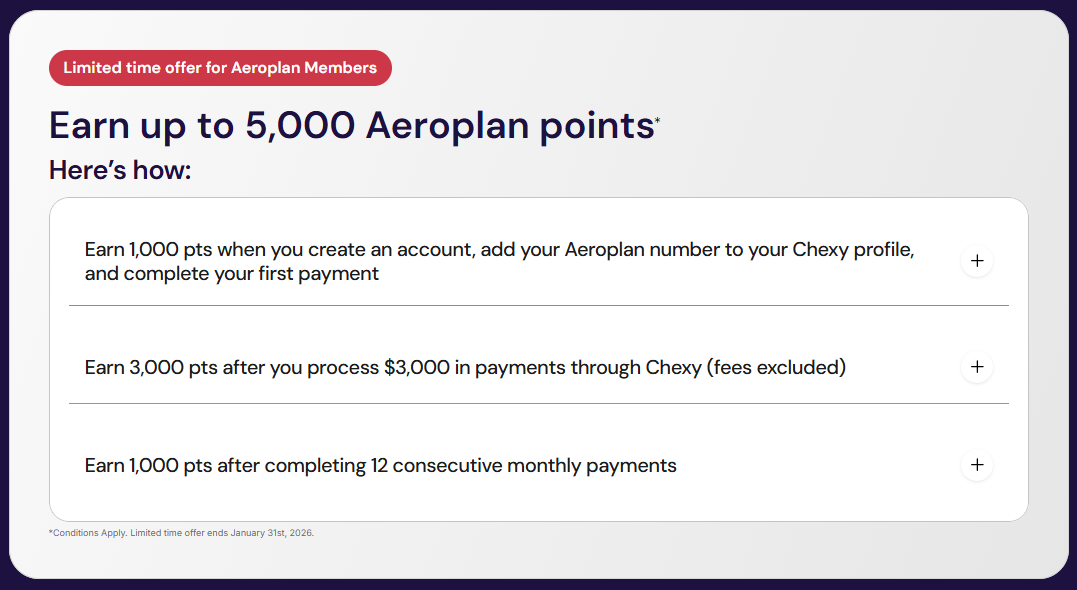

Chexy also prompted me to enter an Aeroplan number to earn points on my rent payment. I do not collect Aeroplan points, so I skipped that part. If I were an Aeroplan member, I would have earned 1,000 points on my first rent payment and 4,000 points on subsequent payments. Points are worth about 1.4¢on average. That works out to at least $14 worth of points on my first rent payment, and about $56 on the subsequent rent payments.

Setting Up My Rent Payment

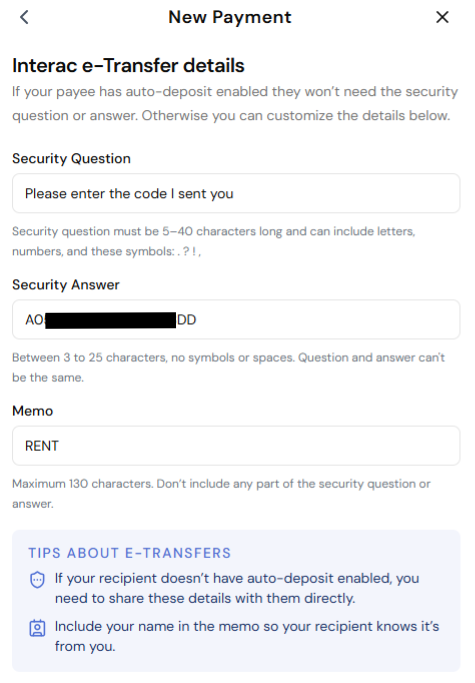

From there, I entered my landlord’s name, email, and phone number. Chexy makes a point of saying they do not call your landlord. They only need the information for compliance. The platform generated a security question and answer for the eTransfer. My landlord uses auto-deposit, so this was irrelevant for me, but I saved the info anyway (just in case).

I reviewed the details, uploaded the photo of my lease, added my Tangerine Visa Debit card, and scheduled the payment. Chexy told me they would charge my card on November 26th, then send rent on December 1st. At that point, everything looked like it was good to go.

The Glitch That Rocked My Nervous System

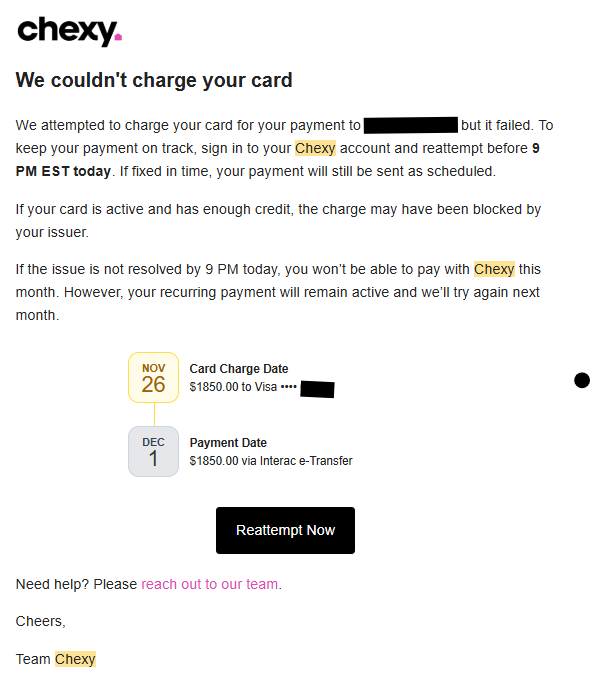

But the next morning, I woke up to an email saying my rent payment had failed. Cue panic mode! Apparently, my card had been declined and rent would not be sent unless I fixed it before 9 PM Eastern. Nothing spikes my anxiety quite like being told my rent didn’t go through, even though I did everything right!

A little while later, I got a follow-up email. Chexy said that some transactions did not go through properly because of an issue with their payment processor. They had already found the problem, fixed it, and my rent payment was still on track. So… that means the first email was actually wrong, and my payment was unaffected? Ok, now I’m just getting pissed.

Then the CTO (Chief Technology Officer) emailed everyone with a full explanation of what happened. He said their payment processor sent them incorrect data that falsely showed failed charges. Chexy’s system reacted to that bad data, automatically sending ‘payment failed’ alerts to customers, even though the payments had not actually failed.

He took full responsibility, apologized, and explained what changes were being made to prevent this from happening again. He even refunded people’s processing fees. I hopped over to the r/Chexy Reddit group to get the tea. Apparently, this is a recurring issue and people are not impressed. The general sentiment seems to be “Hey Chexy, get your shit together.”

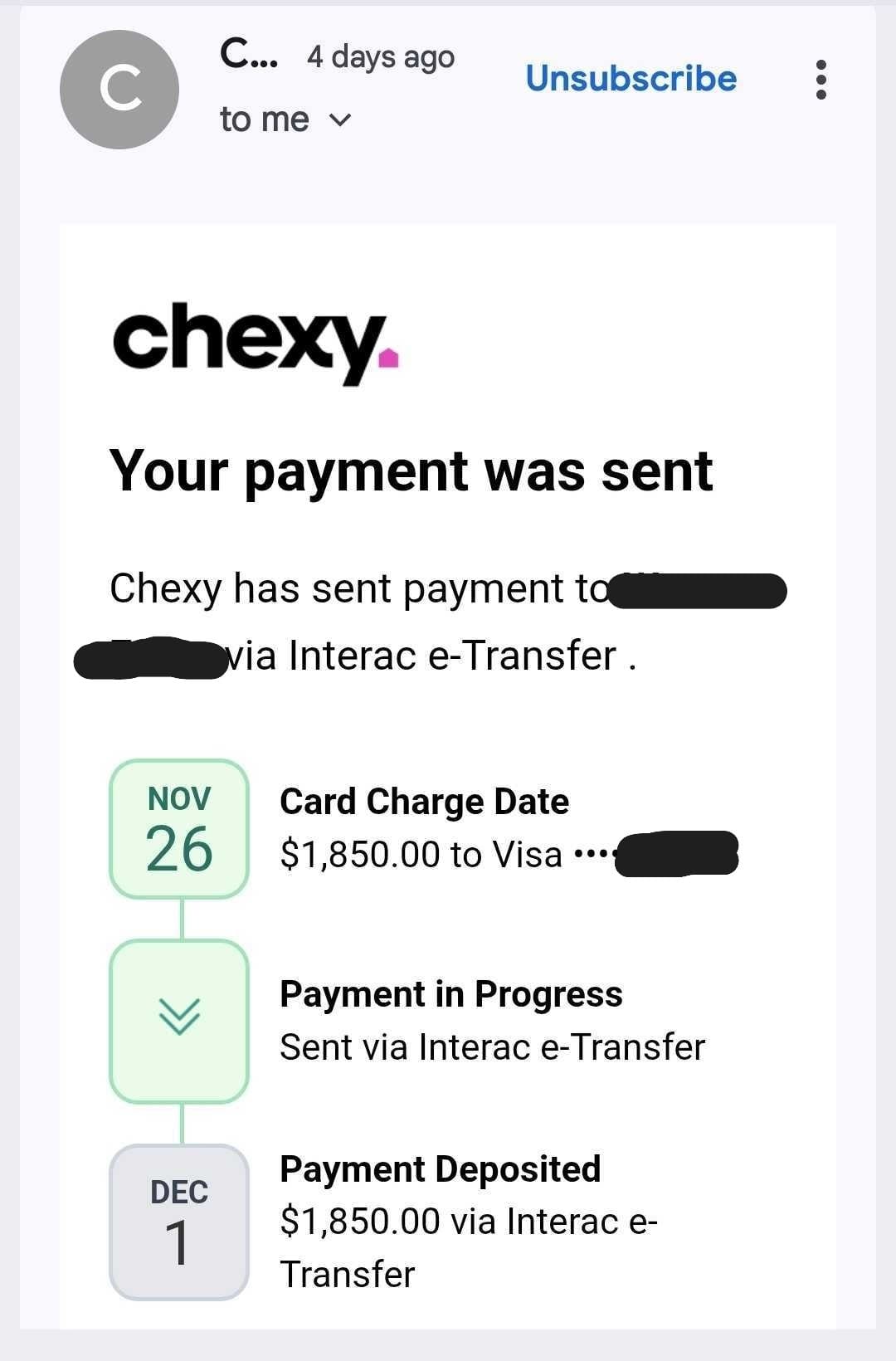

On December 1st, the day my rent was due, I received a final confirmation that the eTransfer had been sent successfully. They said my landlord would receive it between noon and 7 PM Eastern. It did, and my landlord received it without any issues.

Despite the shenanigans, I was actually impressed with how discreet everything was. I did not have to tell my landlord anything. On his end, Chexy shows as the sender, but he wasn’t personally involved in the process. The transaction included my name and the rental property address, so he knew which tenant paid. As of December 5th, he has not contacted me with any issues or questions regarding my rent payment.

But Wait, Does This Even Make Financial Sense?

With rent squared away, I sat down and crunched the numbers to see if paying with my credit card would have even been worth it for me. Spoiler, the answer is NO. If I had been able to use my PC Mastercard, I would have earned 1% back in PC Points. I also would have lost money.

My rent is $1,850, so I would have earned $18.50 worth of points. But the Chexy fee on credit cards is 1.75%, which works out to $32.58. I would have ended up $13.88 in the hole. The points don’t even come close to covering the fee.

Paying rent with a credit card only works if my rewards rate beats the Chexy fee. My PC Mastercard does not. So I’d lose money every single time I pay rent. That’s stupid. Why would anyone do that?

A Card That’s Actually Worth It

So I went looking for cards that would actually put me ahead instead of bleeding me dry. That’s how I landed on the Scotiabank Momentum Visa Infinite. I plugged my numbers in the rewards calculator on the Chexy website, and the cashback was so badass.

The card treats Chexy payments as recurring bill payments, which means I would earn a 4% cashback rate. Minus the Chexy fee of 1.75%, that gives me a net positive cashback rate of 2.25%, which is still higher than most cashback rates on the market. Finally, the math was mathing.

If I had this card and used it to pay my rent every month for a year, I would make an easy $500. My rent totals $22,200 annually. A 4% cashback rate on that is $888. Subtract the cumulative Chexy fees of $388.50, and I’m left with $499.50.

Even in the second year of having the card, when the annual fee of $120 kicks in, I would still come out ahead with $379.50. There are many cards that actually earn money on Chexy, but the best one is the Scotiabank Visa Momentum Infinite card, hands down. Even the Reddit group hails this as the best card.

The Part Where I Beg You Not to Use Credit for Rent

Now I need to make something abundantly clear. Do not put your rent on a credit card because you are short on cash. The platform fees suck, but the interest is worse. The moment you can’t pay the balance in full, interest snowballs and your rent just got hella more expensive.

Next month, rent is due again. Now you’re trying to cover two payments with money that wasn’t even enough for one. And that’s how you get trapped in a financial clusterfuck that’s almost impossible to escape.

The only time paying rent with a credit card makes sense is when that cash is already in your account, and you’re doing it purely for the rewards. Otherwise, you’re on the highway to financial hell.

Will I Keep Using Chexy?

No, not in the near future because I don’t have a Visa credit card. I could apply for the Scotiabank Visa Momentum Infinite, but that requires a hard credit check. Hard credit checks can temporarily lower your score, and I’ve already had a few this year. I’m not willing to take another hit unless absolutely necessary.

An extra $500 a year is super tempting, I’m not going to lie. Right now, my gut says to wait a few months and apply for the card next year. If approved, then I will definitely be paying my rent with a credit card and pocketing the cashback.