The loan documents in my hand flaunted a 1,022% Annualized Percentage Rate (APR). I wasn’t sure if I should laugh, cry, or call the police.

But when the bank slams the door in your face and your credit card’s maxed, what other choice do you have? I did this as an experiment for the article. It’s definitely not a life hack I endorse.

Denied Before I Even Got in the Door

I’m a self-employed freelance writer. Which means I don’t get a regular paycheque, and my income is spectacularly sporadic. Some months, I’m flush with cash. Other months, I’m a broke joke. Like this past July, when I took the month off to chill on the beach with my kids.

So when I decided to apply for a $200 payday loan as part of a writing assignment, I hit a brick wall. I had a feeling I wouldn’t qualify. After five years working for a national subprime lender in Canada, I know the drill.

I applied online first to save myself a trip to the branch. Sure enough, I didn’t qualify. The online application asked me only two qualifying questions:

- How much is your rent?

- What is your monthly income?

Well, I don’t have monthly income. So I averaged what I made to date, divided by 12. Rejected, as expected.

My husband took one for the team and applied for a payday loan in my stead. I tagged along to document the experience. We walked into Money Mart at 11:45 am on Saturday, August 30th.

The place was eerily clean. Sterile, even. Leaning against the counter was a guy in blue jeans, a nice collared shirt, AND1 high-top sneakers, and perfectly groomed facial hair. Behind him sat an older man in khakis, a crisp white shirt, and a well-worn ball cap.

Not exactly the cast of desperate borrowers I was expecting. They looked like my friends and neighbours.

By 11:51 am, it was our turn.

Step Right Up: Inside the Payday Loan Process

The cashier looked like your stereotypical university student. She was kind, soft-spoken, and very articulate. I bet she’d make an excellent teacher. But today she was the gatekeeper of my husband’s $200 payday loan request, and she wasted no time getting down to business.

First came the basics. His phone number, photo ID, and email address. Then she texted him a verification code, which he had to read back to her out loud. After that, she wanted proof of income.

But his last two pay stubs alone didn’t cut it. She also required a recent bank statement to confirm that he had an active bank account and that his pay actually went in there. “Nothing personal,” she said with a polite smile, “there’s just a lot of bad seeds out there.”

Translation: prove you’re legit or NO MONEY FOR YOU!

Once everything checked out, she presented the offer. He could borrow up to 30% of his most recent paycheque. In his case, he qualified for $522. We took $200.

Here’s What We Signed Up For

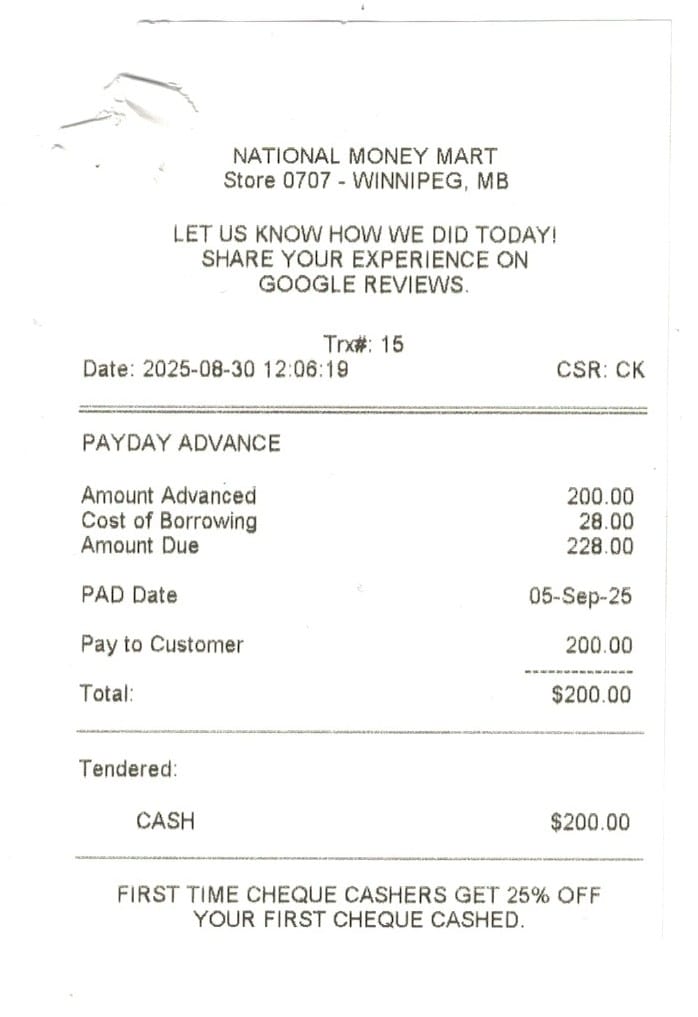

So what does $200 of quick cash really cost in the land of legal loan-sharking? Well, it’s not that bad, at first glance. Here’s the surface-level math, as explained by the cashier:

- Borrow: $200

- Repay: $228

- Fee: $28 ($14 per $100 borrowed)

- Due: September 4, 2025 (next payday)

He signed some documents and slid a void cheque under the bulletproof glass. For repayment, he could either visit the office before the due date and pay by debit, cash, cheque, or money order. Or it could be automatically debited from his account on payday. We chose the auto-debit for convenience.

By 12:05 pm, we were out the door with a stack of crisp twenty-dollar bills in hand.

I repaid the loan a day early. Instead of $228, it cost me just $222.40, a savings of $5.60. That confused me, to be honest. I thought it was a flat fee. Turns out, it’s calculated as daily interest, so you can shave off a few bucks if you pay early.

How a $28 Fee Turns Into 1,022% APR

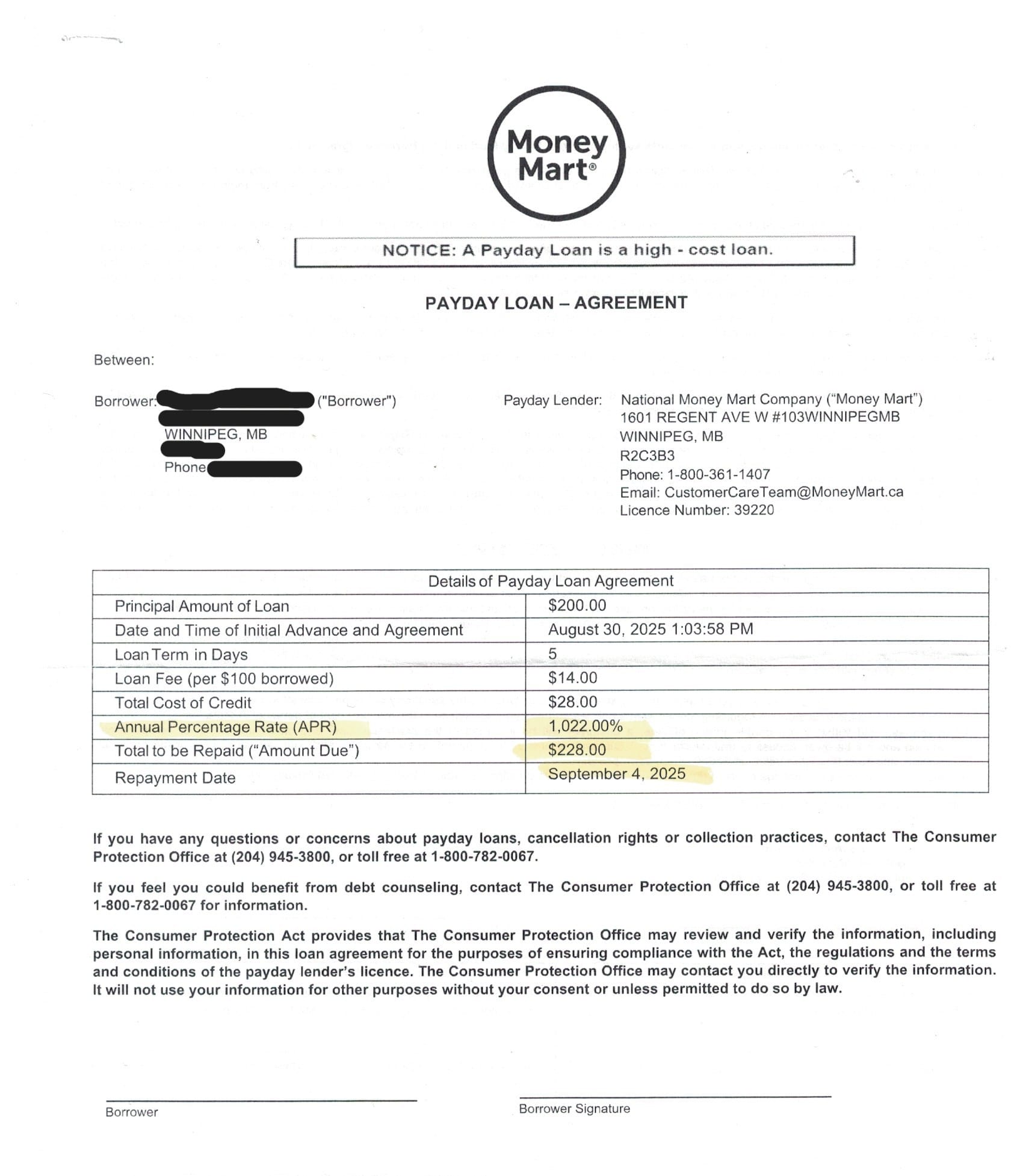

When I got in the car and unfolded the loan documents, my flabbers were gasted! The disclosure box showed an Annualized Percentage Rate (APR) of 1,022%.

Excuse me, what?!

Isn’t the maximum interest rate in Canada 35%? HOW IS THIS EVEN LEGAL? I needed answers. So I sent a screenshot of the document to my legal contact. Enter Scott Terrio, Insolvency Trustee at Hoyes Michalos.

“$14 on every hundred annualized, with $200 borrowed? Looks about right, yeah,” Scott told me after reviewing the paperwork. He confirmed that effective January 1st, 2025, Canada set a new nationwide cap on payday loans at $14 per $100 borrowed.

Back up. My APR was nearly 30 times higher than the criminal interest rate limit! What the hell? To my dismay, it’s totally legal because licensed payday lenders are exempt from the federal 35% cap if they’re provincially regulated. What a slick loophole.

They can legally charge me 1,022% APR as long as they follow certain rules:

- The loan is $1,500 or less

- The term is 62 days or less

- The total cost of borrowing stays under the maximum set by regulations

- The lender is licensed by the province in which it operates

- The province has its own laws to regulate payday loans

If all those boxes are ticked, then the federal 35% cap does not apply, even when the APR is ludicrous. But then why show the APR at all? That’s not a good look for payday lenders that already have the cringiest reputation.

What Payday Lenders Must Tell You (By Law)

Turns out, APR is both a federal and provincial disclosure requirement. Lenders must show it to borrowers so we can accurately compare different credit products. But with payday loans, the math goes absolutely bonkers.

$28 on $200 for 5 days is 14% interest. But annualize that over 365 days, and *BOOM* it explodes to 1,022%. Here’s how they calculated my APR:

Step 1: 0.14 (rate) ÷ 5 (term in days) = 0.028

Step 2: 0.028 x 365 (days in a year) = 10.22

Step 3: 10.22 x 100 = 1,022%

Did I actually pay 1,022%? No, thank god. And most people don’t. It’s just disclosure math, not reality. But it’s designed to scream “THIS IS THE MOST EXPENSIVE LOAN YOU COULD POSSIBLY TAKE!”

By Law, Manitoba makes payday lenders spell everything out in black and white. The documents have to say, “This is a high-cost loan,” tell me exactly when I borrowed it (to the minute!), and even hand me a cancellation form in case I change my mind and want to cancel the loan within 48 hours.

The loan agreement itself has to show who the lender is, how much I’m borrowing, when it’s due, all related fees, and yes, the APR that made me audibly gasp and clutch my invisible pearls. Disclosure requirements can vary by province, so I implore you to know the rules before engaging with a payday lender. Or any lender for that matter.

Boring? Yes. Necessary? Also yes. But to their credit, Money Mart nailed it. I visited the Government of Manitoba’s Consumer Protection Office website and compared the rules to what appeared on my paperwork. Nary a beat was skipped.

Well done, Money Mart. Slow clap.

Here’s where to find the official regulations in your province:

My Biggest Complaint About The Process: Misinformation!

When I asked the cashier, “What happens if we default?” some super important information was left out. And some of it was wrong entirely. She said there would be a $2 fee if we’re late, and if it “drags past the end of the month, there’s like another $10 fee, I think.”

What does the fine print actually say? If my pre-authorized debit or post-dated cheque bounces, Money Mart hits me with a $20 NSF (Non-Sufficient Funds) fee. That’s in addition to the NSF fee my own bank will charge on their end. So the fees from one missed payment can snowball before I even know what happened.

Money Mart also tacks on 2.5% interest per month on the overdue balance until it’s fully paid. That’s a 30% APR… on top of the already insane cost of borrowing. Deep breaths, Heidi.

While not in the fine print, the cashier did tell us that after 120 days, the loan gets reported to the credit bureaus and sold to a collection agency. Based on my professional experience in subprime lending, I know this to be true.

What Money Mart Taught Me About Myself

The entire process, while quick and easy, was a humbling experience for me. After five years underwriting high-cost subprime loans for a living, consolidating payday loans for my clients, and making collection calls on delinquent files, I really thought I was immune to financial stigmas.

I wasn’t. And I was kind of a jerk about it. Please forgive me. Standing in a clean office, behind a sharp-dressed man and a senior who reminded me of my dad, I needed to take a seat. These borrowers look like the people I love. They look like me.

Yes, the 1,022% APR made me feel super gross. But not the establishment itself, and certainly not the people in it. The real problem here is that payday lenders exist because they have to. Because nearly 5 million people have no other options. Banks won’t touch them. One in six Canadians are underbanked, and one in two are just $200 away from catastrophe.

When your car breaks down on Tuesday and rent is due Friday, payday lenders fill the gap while the Big Banks look away. So if you're in a pinch and have exhausted all other options, take only what you need, pay it back in full, and on time…

Or it’ll cost you.