We already know how important it is to monitor your credit score. It is linked to almost every aspect of your financial health. In recent years, I’ve also noticed an increase in free apps, credit cards, and banks offering free credit reports.

Just how accurate are websites like Borrowell and Credit Karma, and how do they stack up to the official agencies like Equifax and TransUnion? I did the work, so you don’t have to.

Did you know that half of secured Neo card holders improve their credit score by an average of 26 points in just 3 months? Plus, sign up now via the button below and get a $60 welcome bonus.

* Limited-time offer. Only valid for new Neo customers who open their first eligible Neo credit product and make a purchase within 90 days. Limit of one offer per customer. Offer is subject to the Neo Rewards Policy and may be amended or cancelled at any time without notice.

What I did

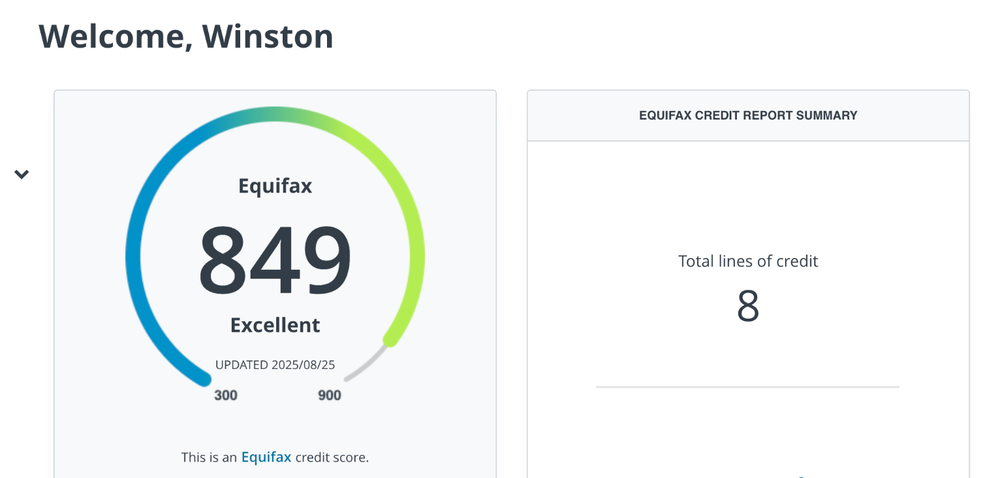

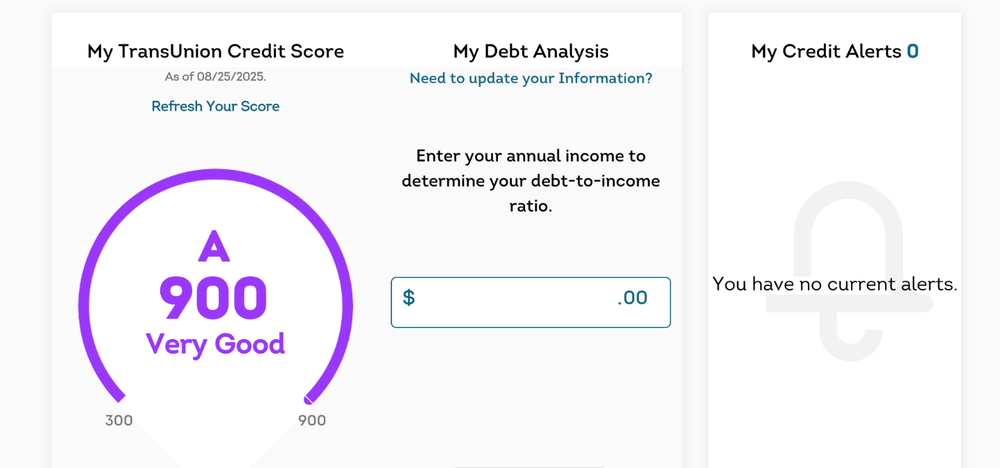

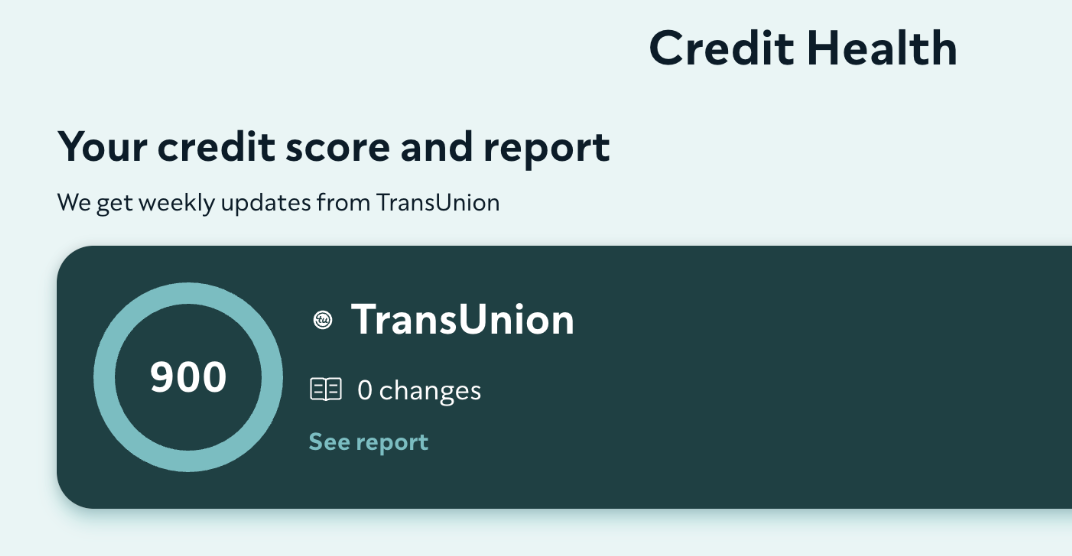

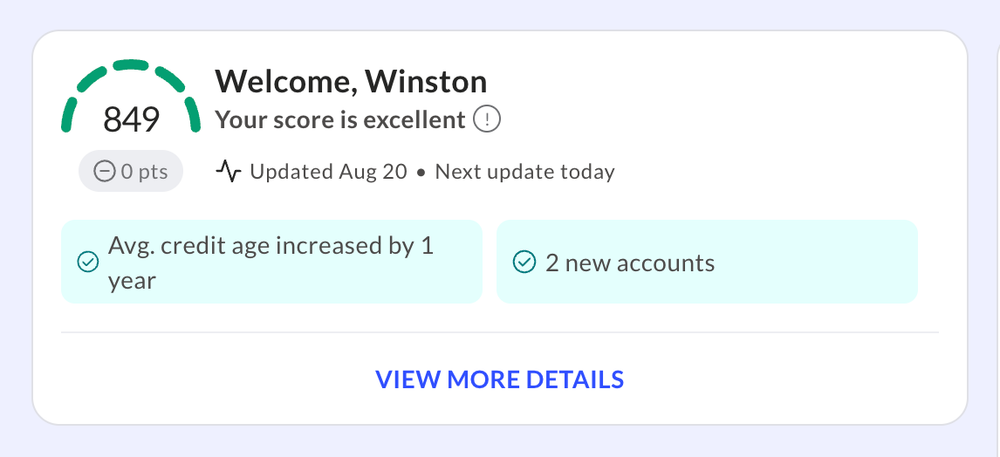

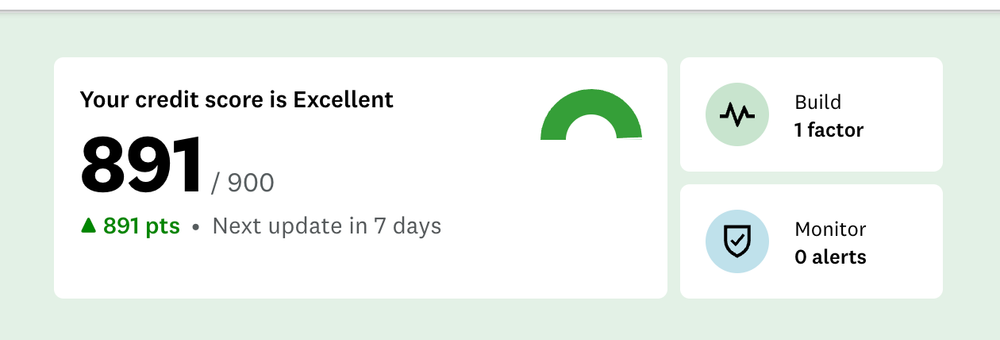

I pulled my credit score in five places. Borrowell said one number. Credit Karma said another. ClearScore had a third. I paid for reports from Equifax and TransUnion and found two more. Same person. Same day. Five grades.

I opened the apps I already use. Then I created fresh logins where I didn’t. I checked my score in Borrowell. I checked it in Credit Karma. I checked it in ClearScore. I downloaded my full reports straight from Equifax and TransUnion. I took screenshots of each one.

From left to right, top to bottom: Credit scores from Equifax, TransUnion, ClearScore, Borrowell, and Credit Karma

The scoreboard

To make it simple, I made a chart so I could fairly compare the tools.

Why do the numbers not match

I interviewed Lesley-Anne Scorgie, personal finance consultant, author, and founder of MeVest, and asked the one question you probably have, too. How can five tools show five scores for one person?

“Each bureau collects and updates information independently,” Scorgie says. “That means not all lenders report to both bureaus, and in the same way. A credit card may appear on Equifax but not on TransUnion. Reporting dates can differ. For example, a balance paid yesterday may show on one report, but not yet on the other.”

For example, my TransUnion score of 900 differed from Credit Karma's score of 891, even though they both pull from the same bureau. Credit Karma doesn’t show you exactly the same model that TransUnion sells directly. Instead, it uses a consumer-facing model built on TransUnion’s data. This is very similar to VantageScore.

The short answer?

While each app can use the same bureau, like Equifax, different websites may leverage a different scoring model.

“Each bureau has its own formula,” Scorgie warns. “Equifax’s Canadian model runs from 300–900, while TransUnion also uses 300–900, but weights things differently, like utilization vs. inquiries. For example, a consumer may be 740 on TransUnion but 680 on Equifax, purely due to weighting.”

What’s even more complex is that lenders sometimes build custom versions for their own products. This is why the Borrowell number can differ from the number you might get from the credit score your bank provides, or from another website like Credit Karma, ClearScore, Equifax, or TransUnion. There isn’t necessarily one single score for all cases.

So which one do lenders use?

It depends on the lender and the product. Some pull Equifax. Some pull TransUnion. Some use a custom score. The app scores help you track trends and spot issues. They are not a guarantee of what a lender will see on decision day. Sometimes you can ask a lender which source they use for further clarity.

“Lenders and banks often use industry-specific FICO or proprietary models, which emphasize different risk factors like payment history on car loans, and mortgage lenders often scrutinize total debt service ratios heavily in combination with scores,” Scorgie says. “Naturally, a Credit Karma, which uses TransUnion’s VantageScore-like model, could easily differ by 20–100 points from what a bank sees.”

Are Borrowell and Credit Karma “accurate”?

In general, these tools are accurate within reason. There may be slight differences in score numbers, and this is precisely as described above.

For example, Borrowell shows your Equifax-based score using Equifax’s model. A lender you may be seeking a loan from may see a different score if they use a different model or a different bureau, like TransUnion.

Are third-party apps safe? Does checking my credit report affect my score?

I have personally used Borrowell and Credit Karma and can confidently say they are safe. Both apps use bank-level security and offer two-step verification, plus you can verify through the detailed credit report that they are using soft-pull information to give you access to your credit data.

Checking your score is a soft inquiry, which means it does not hurt your score. Only hard checks from real applications can move it, and usually only by a few points.

How often do reports update?

Borrowell refreshes weekly and shows your next refresh date at the top of the dashboard. Credit Karma can refresh as often as weekly when you log in. ClearScore refreshes weekly in Canada. Your score may still change on a slower rhythm if your lenders, like credit cards, only report once a month.

Free vs paid: What I learned after trying the bureau plans

In recent years, credit bureaus have made things much easier, where you can get a free online report and score monthly from Equifax. The same can be said for TransUnion. That is now written into government guidance.

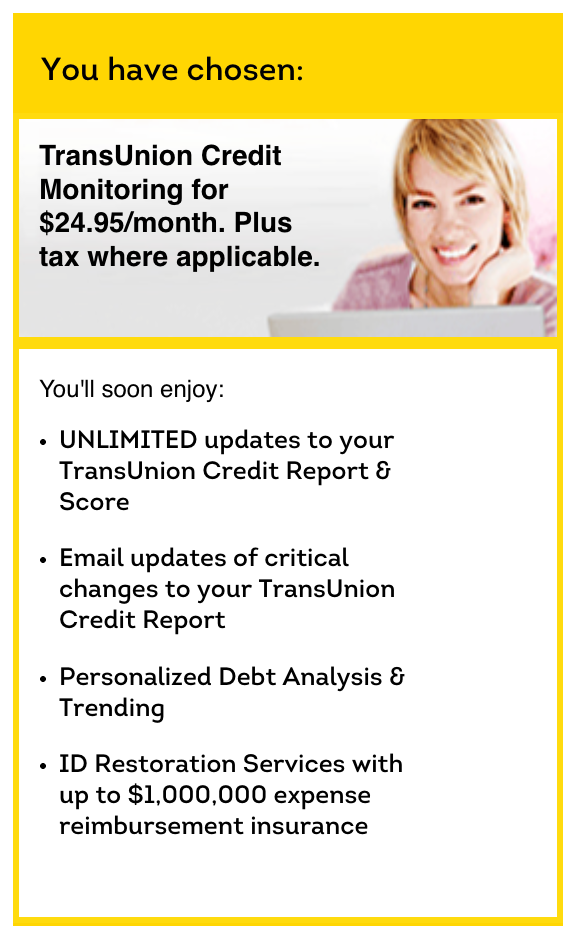

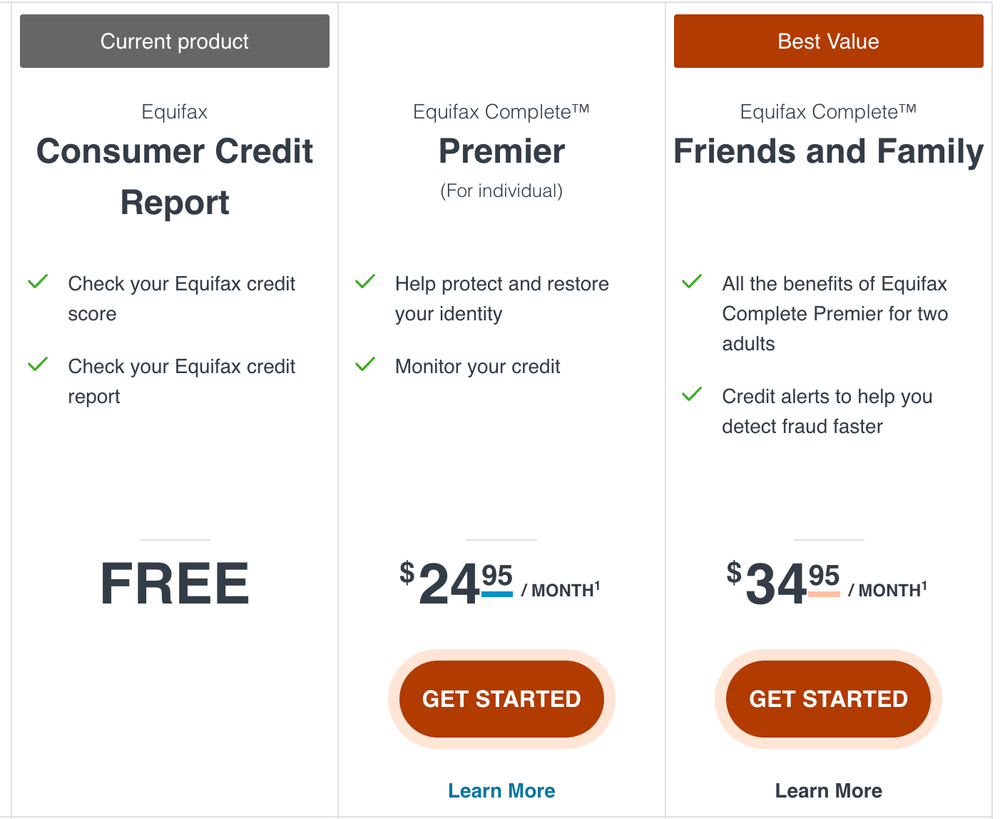

What you do get for a paid plan, though, is if you want monitoring, alerts, and extra tools. For example, TransUnion Canada lists their offering at $24.95 per month, while Equifax Canada markets Equifax Complete plans, including a Friends and Family bundle at $34.95 per month for two adults.

My honest opinion? If you are just tracking your credit and catching errors, the free plans, as well as apps like Borrowell and Credit Karma, are enough. If you think your data was exposed or you are about to shop around for a mortgage, a short paid stint can be worth it for faster alerts and full monitoring.

Bottom line

Use one Equifax-powered tool and one TransUnion-powered tool. Borrowell covers Equifax. Credit Karma or ClearScore covers TransUnion in Canada. That way, you see what both sides know about you.

When asked whether these shifts matter to consumers, Scorgie says it doesn’t generally make a huge difference.

“Consumers will be happy to see trends like an increasing score. But, when applying for something major like a mortgage or car loan, yes, these differences matter,” she says. “If your Equifax score is 730 but TransUnion shows 680, the lender’s choice of bureau could mean the difference between getting prime rates vs subprime rates.”

If you see a surprise account or a late payment that you don’t recognize, dispute it with the bureau that shows it. Errors can cost you real money in higher rates.